Don’t get caught in the debt trap. Use these easy loan tricks for debt payoff and get back on track.

Paying off debts early is one way of saving money. You can devote the money that you save to other more important expenditures (e.g., paying for your wedding). There are lots of reasons why people end up with debt in their lives and what is even worse is when they have multiple debts, but still do not work out a plan on how to pay them all off.

To some people, being debt-free does not seem like something that would be beneficial to them. However, it has been shown time and again that having no outstanding debts at all makes people happier than before.

Many people also think that having debt is a necessity. It is true that there are some situations in which you cannot avoid taking up loans; for example, if you really want to buy something big and expensive (e.g., a house or a car), but do not have enough money to pay for it in cash. Then in order to get, it all you need to do is take out a loan and repay it later with interest.

Given the fact that there are circumstances in which you may need to take up a loan, what is important is how you manage your debts. It is very important to know when it is enough and when you have gotten more than you can handle.

It may seem like common sense, but one of the best things that people who want to get out of debt should do is to make sure that they have paid their bills on time every month. Late payments give rise to interest charges which will add up over time. Instead of this, always keep track of your obligations by setting reminders in your calendar or even in your phone so as not to forget any due dates.

I sat down with a blogger friend recently to talk about why it’s so hard to save money and avoid the debt trap. Stubborn wage growth for most families was a big factor but that was only the beginning that tricked people into a life of borrowing and debt.

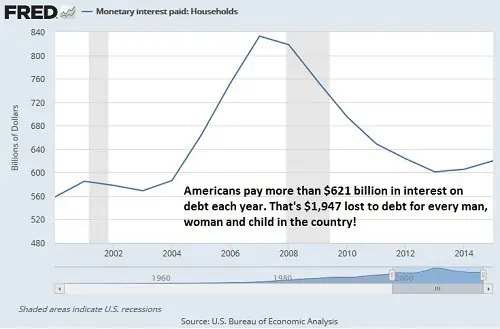

American households lose more than $621 billion to interest payments every year. The average household owes more than $266,000 in debt and over $16,000 in credit card debt alone.

Debt has gotten so bad that the average household loses a tenth of its disposable income just to the interest payments.

Above all the political, economic and social problems we worry about, the debt epidemic stands as the biggest threat to America and our way of life.

That’s why I teamed up with other financial experts to put together this list of the 15 best loan tricks you can use to ditch your debt. From ways to pay off debt to making more money and saving on interest rates, we’ve got your solution.

Loan Tricks to Get Started Paying Off Debt

Some of the best loan and debt tricks start with waking up to the harsh reality of borrowing money. Shopping is fun! Yeah, I get it but that designer back scratcher might not be worth paying two- or three-times the store price in interest payments.

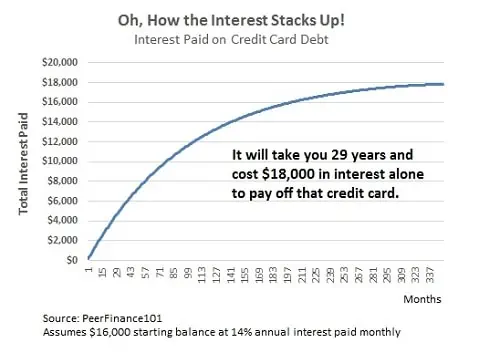

1) This first loan trick isn’t a trick at all but the wake-up call you need to give yourself. Most credit card statements hide the actual payoff information even though they’re required to show it by law. Check out how long it will take to pay off your debts and how much in interest you’ll end up paying.

At a 14% annual rate, interest on a purchase doubles the store price in just five years when compounded monthly.

Most credit card companies calculate your monthly payment at all interest plus 1% of the principal. That makes for an eternity paying off the debt and financial ruin in interest payments.

On that average $16,000 credit card debt and at a 14% rate, you’ll be paying for more than 29 years and will lose $18,000 to interest alone…and that’s if you don’t charge anything else to the card!

Check out some of the different loan tricks below and you’ll find all the motivation you need to tackle your debt. It takes a new mindset on spending but will put you on the path to financial freedom.

Want to find out exactly how much you’ll save by paying off your loans? Use this debt payoff calculator to see how much you’ll save in interest by consolidating or adding to your payments.

2) One of the biggest impacts to getting out of debt for me was to actually write down how much I owed each credit card and lender,” said Hank Coleman, publisher of the popular personal finance blog, Money Q&A.

For years, I had been hiding my head in the sand, ignoring the growing problem. It wasn’t until I listed out all my debts and their interest rates did I truly realize that I had a problem and set out to fix it. Being honest with yourself and listing out all your debts is the first step to admitting that you have a problem and start the process to get out of debt.

3) I’ve used debt consolidation before to get a handle on high-interest credit card and other bills. It’s a great way to lower the amount you pay on interest and lower the stress of having to pay lots of different debts.

Debt consolidation through a site like PersonalLoans is the most popular use of personal loans and peer lending, taking out one big loan to pay off several others. The idea is simple but can have a lot of benefits.

- If the rate on your personal loan is lower than the interest on debts being paid off, you will save money on interest. Paying off $15,000 in debt that charges a 14% rate with a consolidation loan at 8% will save you almost $2,700 over 36-months.

- By lowering your interest rate, you also lower the monthly payment owed each month. On the 36-month loan above, you would lower the payment from $349 to $304 per month. You save $45 a month on this loan trick for doing nothing.

- You have just one payment to make each month instead of several. Three in 10 people that missed a payment in the last six months told Pew Research that they simply forgot to send in the payment. Missing a payment is a huge hit to your credit score and will cause rates to go up on credit.

- Debt consolidation can potentially save you even more money if you put the money saved each month back into paying down debt.

Check your rate on a consolidation loan, won’t affect your credit score

4) Start a loan jar to pay off debt. This is one my wife and I used after getting married. We both had credit card debt and we didn’t want to start life together being buried under interest payments. Not only did we pay down our credit cards faster but the loan jar actually became fun.

Each day we would put our spare change or even a dollar or two in the jar. With each day we put money in, we would say something that we wanted to do when we were debt free. It was great motivation and we were able to save up an extra $40 to $80 each month to pay down debt.

Get Your Boss to Help You Pay off Debt

These next two loan tricks are my favorite because they are so unique and many people don’t know how powerful they can be to living debt free. What could be better than getting your employer to help pay off debt?

5) This one is just for paying down student loan but could save you tens of thousands. There is a federal program called the Public Service Loan Forgiveness Program that forgives the remaining balance on your direct loans after you have made 120 monthly payments while working for a qualified employer.

Qualified employers include:

- Federal, state, local or tribal government organizations

- Non-profit organizations with 501c3 status

- Military service

You must work at least 30 hours a week to qualify under the program but your monthly payments don’t need to be continuous. For example, you could make 48 student loan payments while serving in the military, work at a non-qualifying employer for a few years, and then make the remaining 72 monthly payments while working at a qualified employer.

Your loan forgiveness isn’t automatic once you hit 120 payments so make sure you visit the Federal Student Aid website to get an application. One warning, you may have to pay income taxes on the amount forgiven which could result in thousands owed at tax time. It’s still an amazing deal though and one of the best loan tricks I know.

6) When you start seeing your annual raise come through your paycheck, what do you do? If you’re like most people, you start to loosen up your budget a little and enjoy the fruits of your labor.

I’m not saying you can’t enjoy what you earn but why not put a little of that extra money to paying down debt each year? You’re not going to be missing any of that money because you didn’t have it before. A 3% raise on $36,000 means an extra $90 a month closer to being debt free. Put that money to paying down debt at 14% and not only can you save hundreds in interest but you’ll also save months’ worth of payments.

Saving is so hard because people don’t see how fast it adds up. For a little more motivation, try using this savings account calculator to see how fast your savings will grow.

Adjust Your Loan Payments for Fast Debt Reduction

The fact is you don’t need to do much to save on interest and pay down your debt fast. There are a couple of popular loan tricks that just involve little changes to payments that lead to big savings.

7) Bi-weekly payments are one of the easiest and most popular loan tricks. Most loans are paid on a monthly basis so you make 12 payments a year. This contrasts with the fact that many people get paid every two weeks. Not only does the mismatch make it easier to forget about a payment, it also makes for a huge opportunity to ditch your debt.

Split your loan payment in two and make a payment every two weeks. If your mortgage is $840 each month then pay $420 every two weeks. Most lenders will even let you set it up to automatically come out of your checking account this way.

On a $200,000 30-year mortgage at 7% interest, paying twice a month would save over $70,000 in interest payments and you’ll pay the loan off six years sooner.

The reason the bi-weekly payment loan trick works is because you’re actually making an extra payment each year on your loan. If you pay every two weeks then you are making 26 payments in a 52-week year. If each of those payments is half your normal monthly payment then that equals 13 payments. The fact that you get paid every two weeks though means you don’t feel the squeeze from making that extra annual payment.

The loan trick works on other types of loans as well so use it to pay off your car and any loan with a fixed monthly payment.

8) Rounding up payments won’t save you nearly as much as making bi-weekly payments but it will still save money in interest and your sacrifice comes down to a few bucks. The trick here is to round your loan payments up to the nearest dollar amount or higher.

For example, if your mortgage payment is $968.68 then you could send in a payment every month for $970 or even round it up to $1,000 each month.

That $1.32 extra each month will save you $1,129 on a 30-year $145,000 loan. That’s less than a nickel a day but can save you more than a thousand dollars on your loan. Go a little further with the extra $31.32 payment each month, still only a dollar a day, and you’ll save over $23,335 in interest payments and will pay it off in 27 years instead of the full 30 years.

Budget Tricks that Work Like Magic on Debt

Sometimes it’s going to take more than just loan tricks to get a grip on your debt. That’s where taking a look at your spending and using a little budget magic can come in handy.

9) Spending challenges are a fun way to save money and they don’t have to mean big sacrifice for the shopaholics. Pick a challenge each month or even every two months to follow. This would be something like not eating out for a month or not buying designer clothes for a month.

The average American eats out five times a week including lunch and dinner and spends over $2,660 a year on food outside the home. Resolve to not eat out for a month and you could save $200 or more to put towards extra payments on debt.

Best Spending challenge ideas:

- Don’t eat out for a month

- Take public transportation for a month

- Don’t visit a mall or retail store for a month

- Don’t buy any designer clothes for a month

- Don’t buy soda or other junk food for a month

- No drinking for a month

- Only buy necessities for a month

Keep track of how much you spent the month before and how much you saved during the spending challenge so you can put that money to paying down debt. If you want to reward yourself a little at the end of the month, go for it but don’t splurge and spend all the money you saved.

A twist on the spending challenge takes it to a psychological level. Research shows that it takes about eight weeks to develop a habit. That means if you make your spending challenges two months each then you’ll develop some great habits that will become easier even after you stop consciously challenge your spending

10) John Schneider of Debt Free Guys writes, “The number one reason we could pay off $51,000 in 2.5 years is that we figured out what we most wanted in life. When we finally talked about what we most wanted and then assessed our spending, we learned they weren’t congruent.

When we got our spending in line with our goals and used our goals as motivation to pay off our debt, managing our money became so much easier. It’s our focus on our goals that got us out of debt and it’s our focus on our goals that has kept us out of debt.”

I love this focus on goals as a way to really put perspective on your debt. Did those designer cuff-links really do anything to make your life better or fit with your long-term goals? Sit down and visualize what you want in life, what it looks like and the big ideas around it. Don’t just write down your goals but have a mental picture of where you will be and what your daily life will be like.

It’s this mental image that will help motivate you and drive you through budgeting and paying off debt.

11) Holly Porter Johnson of Club Thrifty and is the author of Zero Down your Debt. “The best way to get out of debt is to start tracking your spending and using a budget. These two steps will help you identify budget drains and save more so you can throw more cash towards your debts.

Our favorite type of budget is the zero-sum budget. With this budgeting method, you assign each dollar you earn “a job.” This eliminates waste and ensures you’re maximizing your income. Obviously, the less money you’re wasting each month, the more money you can use to pay off debt faster.”

There are all kinds of budget tricks that will help you ditch debt fast. One of my favorites is to simply ‘turn your budget upside down’. Instead of taking your expenses out of income first and then saving whatever is left, take some money out first for saving and an extra payment on your debt. Then start budgeting for expenses. If there isn’t enough to cover all your expenses, start cutting the least important until you reach zero.

Too many people take their expenses out of income first in their budget. They barely have enough to cover expenses but think it’s ok because at least they’re not in the hole. They’re never able to save any money and one financial emergency sends them into debt. Turning your budget ‘upside-down’ prioritizes saving and helps you see which expenses can be cut most easily.

Debt Prioritization Tips to Pay Down Debt Fast

Sometimes all it takes is moving your debts around a little to get the motivation to pay them off faster. I’ve got two loan tricks to help you save on interest and push you to keep paying down debt.

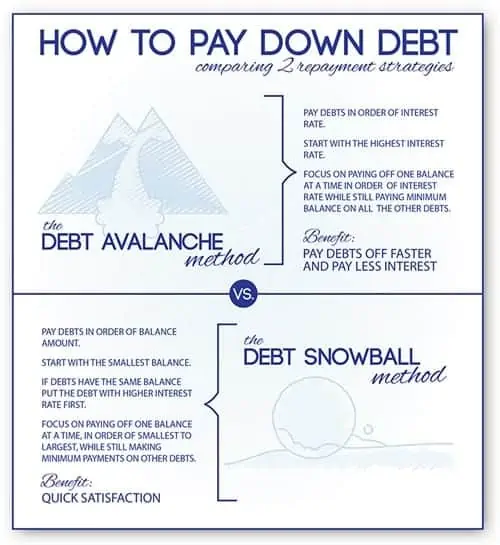

12) The two most popular debt prioritization tricks are the Avalanche Method and the Snowball Method.

In a debt avalanche, you list all your debts in order of interest rate from highest to lowest. This usually means listing out credit cards first, followed by car loans and personal loans and finally mortgages and student debt.

You then make extra payments to the one or two debts on the top of the list, those with the highest rates. You’ll make progress on paying all your debt off and will pay off the worst debt faster. The debt avalanche method makes the most sense because you’ll save more on interest payments by paying off those high-rate credit cards first.

In the debt snowball method, you list all your debts in order of amount owed from smallest to largest. This may also mean listing out your credit card debts first but it has nothing to do with interest rate. Just like the avalanche method, you make any extra payments to the one or two debts at the top of your list (the ones on which you owe the least amount of money).

If your high-interest credit cards are also your smallest debts, then you will save a lot of money in interest with the snowball method but it’s real power is in the motivation. It’s not always easy sacrificing, sticking to a budget and making extra payments on debt. With the snowball method, you’ll get the motivation from watching debts drop off your list faster. That might just be enough to keep you on budget and reach debt free.

13) Craig from Retire before Dad offers another twist on debt prioritization with, “If you have high-interest credit card debt, that should always be the first to go. But for those struggling to pay off multiple lower interest rate loans, such as student debt, home equity loans, or car loans, you can accelerate your progress by paying off the loan with the highest payment first, even if the rate is lower. Doing so frees up cash flow.

For example, our family had a $12,000 car loan balance and the rate was only 0.9%. But the $563 monthly payment was strangling us. So we focused on eliminating that debt first. The extra $563 per month gave our budget some breathing room and helped us pay off other debts quickly.”

I’ve got to say that I never heard of paying off the biggest monthly debt expense first but it makes a lot of sense. Getting that one large monthly payment dropped off your list makes for a lot of money you can shift to saving and meeting the rest of your financial goals.

Want to save more but don’t know where to start? Check out these 20 Money Saving Tips that add up to $7,500 a year in savings.

Fast Loan Tricks from the Income Side

These last two loan tricks aren’t even about debt but can help you reach financial independence just the same. A lot of the conversation I had with my blogger friend that started this post revolved around the fact that people just barely get by on their incomes. The average American household makes just over $50,000 a year and that’s not enough to support a family even in smaller cities.

That means paying down debt and reaching financial freedom needs to come from finding other sources of income.

14) Call it the side hustle, the gig-economy or just good ol’ fashioned entrepreneurship but there are hundreds of ways you can make extra money outside your 9-to-5 job. I’ve spent so much time learning about side hustle strategies that I started a new website called My Work from Home Money to share all the ideas.

Don’t think of your side hustle as another job. Start it in something you enjoy doing. It will seem more like a hobby that you get paid to do. Not all side hustle ideas will make lots of money but every dollar gets you closer to paying off your debts and you may eventually find you’re making more money on your side project than you are at work.

That’s what happened to me when I left my job as an economist in 2013 to focus entirely on work from home projects. I had my best month yet in January, bringing in $11,139 from freelancing and blogging:

- Freelance writing as an investment analyst: $4,851

- Self-Publishing income from seven books: $1,605

- Blogging income from affiliates and other sources: $4,683

You can freelancing just about anything, even stuff outside traditional job ideas. If it needs to be done then you can bet someone doesn’t want to do it and you can make money doing it for them.

15) Crowdfunding has become a great way to raise money for all kinds of small business ideas and social projects. If you are just looking to pay off debt or cover emergency expenses then you’ll want to use one of the social crowdfunding sites like GoFundMe or YouCaring. These websites don’t require you give away ‘rewards’ to people that support your crowdfunding campaign like you’ll have to do on Kickstarter.

Be honest in your crowdfunding campaign and tell your personal story. If you just want to get out from a debt trap then say that and tell why it’s important to you. You don’t have to offer rewards but maybe you could offer to invite everyone to a nice dinner once you’ve paid off your debt.

So many of these easy loan tricks aren’t so easy but they will all help you pay off debt faster and reach financial freedom. Don’t feel like you have to turn your life upside down to get out from under the debt trap and don’t try to pay everything off immediately. Gradually work into some of these methods and don’t forget to live a little in the process. Try out a few of the debt payoff ideas and settle on a few that help you reach debt free!

Read the Entire Loan Series

- Loan Principal, Tricks Lenders Play and How to Pay Off Loans Fast

- What is a Loan Origination Fee? [And How to Not Pay It]

- How Applying for a Loan Can Ruin Your Credit Score

- 7 Student Loan Repayment Options You Must See

- How to Get a Personal Loan with No Credit and No Cosigner