Ultimate list of emergency loan websites and how to get fast cash on bad credit.

More than a decade after the financial crash and banks still haven’t opened up to Main Street borrowers. Loans to corporations are at an all-time high while credit score requirements for regular borrowers never came back down.

Top it off with the fact that paychecks have barely budged over the last 10 years and it’s easy to see why more than six-in-ten Americans say they don’t have enough saved to cover a $400 emergency expense.

And life is full of those ‘little’ emergencies. Information from the Federal Reserve shows Americans rack up more than $3,000 in unplanned expenses each year from medical, family and car repair problems.

So what do you do when you need an emergency loan on bad credit, when the loan officer at the bank won’t even let you in?

What is an Emergency Loan?

When an emergency hits, it’s not just that immediate cash need that’s the problem. Draining your bank account or borrowing on your next check puts you in a financial hole.

When bills come due over the next month, that’s when the hole gets deeper.

You’re forced to go to high-interest payday stores and check advances, paying fees equal to 500% interest a year. That’s when the hole becomes a debt trap that only exits in bankruptcy.

Emergency loans are short-term, usually less than a year but sometimes up to three-years, to help you pay for those unexpected expenses. While we’ll talk about loans up to $36,000 in the article, most emergency loans max out around a grand or two.

These loans often come with lower interest rates because they’re shorter-term and for lower amounts. That can help you cover the emergency expense plus your upcoming bills and not end up in that debt trap.

Types of Emergency Loans

Doesn’t it seem that unexpected expenses come from everywhere and all at once? Just around the time we were finalizing the adoption of our daughter, and paying some hefty lawyer fees, the car decided to break down and our annual health insurance premium came due.

Even with some money in savings, it didn’t last very long.

Emergency loans can be used to pay for any cash needs including being unemployed for a while and just needing help with the bills. The most common use of emergency cash is for big medical bills, car repairs and…all of the above, all at once!

I’ll share some personal loan websites for bad credit borrowers later but I want to make the distinction between personal loans and emergency loans. While that loan you take out is technically a personal loan, there’s a very important difference you’ll want to make when you’re paying for emergency cash needs.

That cash you apply for should be only as much as you need to cover the emergency expense and your next month’s bills and needs to be paid back as soon as possible.

Borrowing as little as possible and paying it back quick is going to get you the lowest rate available, making the loan easier to pay off, and get you out from under that debt faster. That’s going to be important if you have another emergency cash need within the next year or two.

Check your rate on an emergency loan now – won’t affect your credit score.

What Credit Score Do I Need for an Emergency Loan?

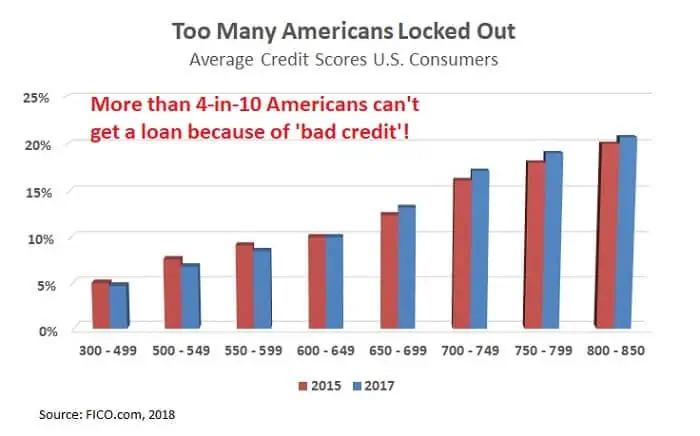

This is the big problem for most people when it comes to getting emergency money. Traditional banks won’t loan to anyone with a credit score under 680 FICO and most won’t consider your application with a 720 FICO or less.

That 680 credit score is the cutoff for what’s called ‘prime lending’ and where the bank gets federal guarantees on the loan. That means the bank can sell your loan to investors or other programs.

Anything less than a 680 credit score is considered bad credit…but includes more than 4-in-10 Americans. According to credit score agency FICO, more than 43% of households have a credit score under that sub-prime cutoff.

Fortunately there are online lenders and non-traditional banks that will work with people that have bad credit. I’ve personally gotten a loan with a credit score of 560 FICO and know others that have gotten loans with scores as low as 480 FICO.

Best Emergency Loan Websites for Bad Credit

I’ve used peer-to-peer loans, personal loans and bank loans at least a dozen times over the past ten years. My first experience with online loans was after the financial crash to consolidate my bills and dig myself out of the debt hole.

Since then, I’ve used or reviewed at least 20 websites and lenders that claim to get you the cash you need as fast as possible. In that list, I’ve found five that offer the best rates for people with any credit score.

PersonalLoans.com is the website I use most often and the one I recommend for most borrowers. I like the site because it’s a loan aggregator, which means it uses a network of lenders to find you the best loan at the best interest rate.

PersonalLoans offers p2p loans, bank loans and personal loans all depending on how much you need and your credit score. The minimum score required is 580 FICO but I’ve seen borrowers get approved for loans with a score a little below this.

BadCreditLoans.com is another website that specializes in bad credit emergency loans and offers the lowest credit score requirement I’ve seen. Borrowers with a FICO score as low as 520 can get approved for a small loan.

The drawback to this one is that it’s not available in every state so you have to check the availability on the site. Another advantage though is BadCreditLoans charges no origination fee, meaning you’ll save hundreds compared to other sites.

Payoff specializes in credit card debt but it’s a personal loan so you can use the money for any cash need. The maximum you can borrow is lower than most sites but still high enough to cover almost any emergency loan need.

Payoff requires a higher credit score on loans but it comes with lower interest rates compared to most sites.

Upstart uses a unique credit-scoring system that takes into account education to approve your loan. That means graduates or younger borrowers might get lower rates and are more likely to be approved for a loan.

SoFi started out as a student loan refinancing company but has since expanded into the widest selection of loans I’ve seen. You can get emergency loans, medical loans and even a mortgage from the site.

SoFi doesn’t disclose its minimum credit score but it’s a little higher than most of the other lenders. It might not be a good choice for bad credit loans but apply anyway because they offer some of the lowest rates available.

| Peer to Peer Lending Site | P2P Borrower Fees | Minimum Credit Score | Loan Rates | Notes |

|---|---|---|---|---|

| Personal Loans Click to Check Your Rate | 5% | 580 | 9.95% to 36.0% | Three options including P2P Loans, Bank Loans and Personal Loans. |

| BadCreditLoans Click to Check Your Rate | No Fees | 520 | Vary by state | No fees and lowest credit requirements with p2p lenders. |

| Payoff Click to Check Your Rate | 2% to 5% | 660 | 6% to 23% | Specializes in loans to payoff credit cards. Low origination fee and no hidden fees or charges. |

| Upstart Click to Check Your Rate | 0% to 8% | 620 | 5.67% to 35.99% | Best for graduates and no credit peer loans. |

| SoFi Loans Click to Check Your Rate | No Fees | N/A but probably around 680 FICO | 5.99% to 16.49% (fixed rates) 5.74% to 14.6% (variable rates) | Low student loan refinancing rates. |

How to Get an Emergency Loan for Bad Credit

Once you know the best websites for emergency loans on bad credit, getting your money is the easy part. All the sites listed above offer instant approval meaning you’ll get a rate quote and know if you qualify within seconds.

All personal loan sites do what’s called a ‘soft inquiry’ on your credit report to verify your score and credit history. This soft-pull doesn’t go on your report so it doesn’t hurt your credit score.

That’s one of the big advantages of personal loans over other loans from the bank or credit card debt. You can apply to multiple online lenders to see which will offer the lowest rate without destroying your credit.

After this pre-approval check, the application process on most loan sites takes less than three minutes. You’ll need your contact information, how much you want to borrow and employment information.

Remember when you’re applying for an emergency loan, you want to request the lowest amount that will cover your cash needs and the shortest time to pay it back.

On most sites, you can borrow as little as $1,000 on terms as short as one year. That’s going to get you the lowest rate available and set you up to pay off your loan and be ready if another unexpected expense hits.

Best and Worst Alternatives to Emergency Cash

Even on small loans, the interest rate for bad credit borrowers will still be around 14% or higher on most peer-to-peer sites and online lenders. That can get expensive so I wanted to share some alternatives to emergency loans…as well as some options you want to avoid.

Nobody likes asking friends and family for money, but sometimes it’s the best option available. Family is there to support each other and we all understand how emergencies happen to everyone.

This isn’t an excuse to take advantage of their generosity. Write out a formal loan document with all the detail you would expect from a bank loan. Include how much you’ll pay monthly, how long you’ll take to repay the loan and penalties for late payment.

Don’t expect friends and family to loan you money for free. They might offer but that only shifts the burden from you to them. You also shouldn’t be expected to pay interest as high as the online lenders charge so settle on somewhere in between.

If you’ve already got a personal loan or other type of loan outstanding, you might try refinancing a loan it for the cash you need to cover emergency expenses.

If you’ve been on-time with your payments for more than a year, most lenders will re-evaluate your loan and either refinance for a longer period or make a new loan to payoff the old and provide extra cash.

This is usually easier than getting a new loan from a new lender because the prior lender already has your information and knows your good credit history.

If you own your home or are making payments, a Home Equity Line of Credit (HELOC) is another option for emergency cash.

A HELOC is a revolving loan secured against the value of your home beyond what you still owe on the mortgage. You get a credit limit from the bank and can borrow on it just like a credit card. Interest rates are higher than a mortgage but usually lower than other types of debt like credit cards or personal loans.

That doesn’t mean you should run to max out your HELOC and borrow as much as available but it’s a great source for low-interest cash.

The best way to pay for emergency expenses, and I realize this is no help at all, is just to save a little money each month in a What-If account. Just $50 a month in emergency savings will protect most families from having to go into debt from unexpected expenses. Even if your emergency savings don’t cover the full amount, you’ll be able to borrow less and pay off your loan faster.

What I don’t want you to do, the worst thing you can do to pay an emergency expense is use payday stores, pawn shops or cash advances. These places charge fees on your loan instead of interest rates because it would be illegal to charge that high a rate in most states.

Most states have a cap of 36% on consumer loan rates. Payday lenders and cash advance stores get around this by charging a per-loan fee of around $15 for every $100 borrowed. Don’t be fooled though, that fee is the same as paying 500% interest a year!

Check your rate on an emergency loan now – instant approval

Paying emergency expenses is a fact of life but it doesn’t have to send you into a debt spiral. Learn how to find the best websites for emergency loans on bad credit and avoid falling into that debt trap. Borrow only as much as you need and pay the loan off as quickly as possible to stay out ahead of life’s little unexpected expenses.