Financial planning in your 30s will make the difference between rich and poor in retirement.

Financial planning in your 30s, it doesn’t sound as sexy as finding hot stocks or making millions on a business idea, but this is the time that will make or break your financial future.

It is here in your 30s that you’ll pick the path between rich or poor in retirement. You’ll either fall into the same money traps as everyone else or you’ll start building your wealth.

I’m revealing three money tips that will put you out ahead as well as three money traps you absolutely must avoid.

We’re building a huge community of people ready to beat debt, make more money and make their money work for them. Subscribe and join the community to create the financial future you deserve. It’s free and you’ll never miss a video.

Join the Let’s Talk Money community on YouTube!

Why Financial Planning is So Important in Your 30s

For most people, their 30s is just when they’re starting to come into more money. They’ve been working for almost a decade and are starting to see those raises, maybe they’ve even been investing and are seeing their portfolio grow.

What you do next will make or break your financial future.

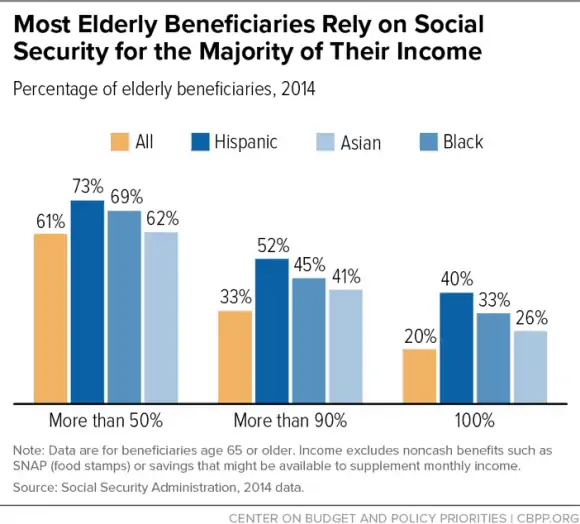

It’s what you do in this decade of your life that will determine whether you beat your goals or if you’re going to fall into those same money traps that catch so many people. Almost seven in ten Americans don’t have enough saved to cover a thousand dollar emergency expense and more than a third of retirees rely on social security exclusively to pay the bills.

That’s living on about a grand a month.

That’s why I’m revealing three money tips and the three most common traps for financial planning in your 30s. The video is part of a series where we’re looking at those crucial three decades of your life, from your 20s through your 40s. These three decades are critical to growing your money and creating that financial future.

3 Financial Decisions in Your 30s

Let’s look at those three money tips for your 30s and then I’ll reveal the three traps that doom 70% of families.

Our first trick here is to fight what’s called lifestyle creep. Lifestyle creep is that slow increase every year of your expenses, the bigger house, the eating out more often.

It’s amazing if you think about it. Somehow you were able to live on a couple grand a month in your 20s and it was the best time of your life. Now in your 30s, you struggle to pay the bills on a budget of double that amount.

And it’s because every year, as your income grows, you grow your spending just a little bit more. You might get a 2% raise but your budget increases three or four percent. It’s that extra night eating out or picking up take-out, it’s the bigger house you justify because you’re making a little more money.

It’s so gradual that you don’t notice but it costs you thousands a year.

Fighting inflation creep is not only going to keep your budget from getting out of control but it’s also going to help you save for retirement. Here’s what you do, every year you get a raise or get a little more money, you increase the contribution to your 401K plan by the same amount.

You can do this without a 401K plan as well but you have to make that commitment to invest that money before it hits your budget. I like the 401K idea because it’s automatic but I’ll share a couple of other ideas in a bit.

Now this doesn’t mean you can’t have nice things and can’t celebrate that raise. You work hard for your money and you deserve to enjoy it. So go out, have a nice dinner with your family when you get your raise but keep to that budget you had before.

Converting into a Roth IRA

Our second money tip, and this one is a great one for anyone in their 20s or 30s, is to convert money from your IRA into a Roth IRA plan.

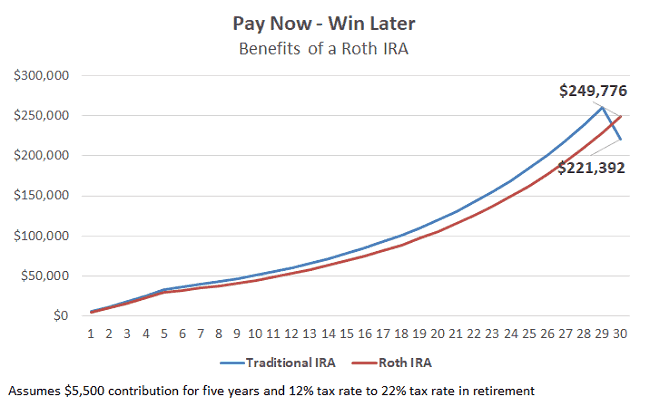

I love those IRA plans for that immediate deduction you get on your income taxes and I know a lot of you do as well. You don’t get to write off those contributions into a Roth IRA so you have to pay taxes now but then get to take your money out tax-free in retirement.

Well, everyone wants to take their deduction now rather than later, right? The average IRA balance according to the Employee Benefit Research Institute is over $118,000 while the average balance in a Roth account is less than $37,000.

But those tax-free benefits are huge in retirement. You not only get to take your contributions out tax-free but also the returns. That means you never pay taxes on your returns.

Compare that with a traditional IRA plan where you might get that deduction for your contribution now, so a little lower taxes, but you have to pay taxes on everything in retirement.

For example, if you invested $5,500 into an IRA for five years and made 9% a year, you’d have over $283,000 at the end of 30 years BUT you’d get hit with a $62,000 tax bill and would only get about $221,000 of that money. Instead if you paid taxes now on that $5,500 and invested the rest into a Roth IRA for the next five years, you’d have almost $250,000 for retirement, all tax free and more than $28,000 than that IRA investor.

The great thing is, you don’t have to wait to invest in your Roth and you can still contribute to your IRA for that immediate benefit. All you do is move some of your IRA money into a Roth account. There’s no limit to how much you can move over. Now you will have to pay the income taxes on the money you convert into a Roth account but your tax rate is probably going to be lower now in your 30s than it will be later in life.

Besides the benefit of getting that tax-free income later in life, I call this one rich guy insurance because if you happen to start making more money whether it’s from a business idea or your numbers come in, your tax rate is going to skyrocket. When that happens, all that money in a traditional IRA or 401K is going to be worth a lot less.

Taking Advantage of Special Savings Accounts

Our third money tip is to start taking advantage of those other tax-advantaged accounts like and HSA and 529 plans.

Most people have heard about those retirement accounts like the 401K or IRA that give you tax breaks but much fewer take advantage of these other special savings accounts. A health savings account, or HSA, is a savings account you can set up through work or a bank. The money comes out before you pay taxes and comes out tax-free if you use it to pay healthcare expenses.

The great thing about an HSA is there’s no time limit on using the money. Even if you’re still healthy, you can contribute to your account, watch it earn interest, and then use it tax-free for those medical bills in retirement. Healthcare costs are growing at about twice the rate of everything else and we’re all going to have these bills in the future, why not use tax-free money to pay it?

The next savings account you should be looking into in your 30s is called a 529 education account. It’s a little different because you pay taxes on the money you put in the account but then all your earnings and withdrawals are tax-free if you use them to pay for education costs. So it’s like a Roth IRA for education expenses.

In my 20s, I was more concerned about my own education expenses than anyone elses. In my 30s and 40s though, those college bills for the kids are getting closer and closer and our 529 is becoming a bigger part of our financial plan. It’s going to save tens of thousands when the time comes and I highly recommend setting one up as soon as possible.

3 Money Traps in Your 30s

Those three money tips alone will help put you on track but now I want to share three money traps everyone in their 30s must avoid.

The first money trap, and this is one that hits so many people, is spending on a big house or new car.

This one is related to that first money tip and lifestyle creep. You start making a little more money, maybe you move to a nice neighborhood and suddenly your possessions become your self-worth. You feel that increasing pressure to keep up with the joneses.

Whenever I hear that expression, I always remember something Dave Ramsey’s daughter Rachel Cruze says, “The Joneses are Broke.”

They buy the new truck with the $800 monthly payment or that gigantic 3,500 square foot house so everyone can have their own private room and private space. Then they have to go on expensive family vacations to bring everyone closer together.

Your value is not your car or your home or that living room set. In fact, your value isn’t even your bank account or net worth. Don’t get trapped into that line of thinking that you need to impress others by being able to buy big shiny new things.

Bad Spending Habits

Trap #2 that is going to come out in your 30s is falling into those bad spending habits that make your money disappear.

This one is another product of our consumer culture. We have to get the newest tech gadget and kitchen appliances and it just traps us into a cycle of debt. Consumer spending drives the economy but it doesn’t have to drive you to the poorhouse.

A lot of this isn’t even those trips to the mall, it’s the little spending we do every day. It’s the spending that doesn’t make our lives any happier but just a little easier for about five minutes. It’s ordering out or eating out three days a week because you don’t want to cook. It’s stopping in at the convenience store for a 32-ounce big gulp and donut every day while you fill up the car.

It’s these little spending habits that drain your bank account and you don’t even see it coming.

Check out this video and the 10 Things You Should NEVER Buy!

Now I’m not saying you can’t have nice things but not at the expense of that longer-term happiness. If you ate out just one fewer time each week, you’d save over $5,000 a year. That’s enough for retirement savings of over $270,000 over 20 years, all from just skipping one mean out.

Make Financial Planning a Family Thing

Our third money trap, and this is easily the worst of the three, is not involving your family in this financial planning.

Not only will this one keep you from reaching that financial future you deserve, I’ve seen it destroy marriages and break up families. You and your spouse have to be on the same page when it comes to spending and saving.

The problem here is that money is a subject almost guaranteed to start an argument. The money talk almost always comes down to you spend too much or why can’t you save more.

Instead of talking about money, you have to start by talking about those shared goals. Start by talking about what each of you want for the future, where you want to be and what your dreams look like. That creates those shared goals, what your life looks like together. Once you agree on this, it’s not about who is spending more or less, it’s about what WE need to do to get there.

You gotta have that money talk but it doesn’t have to be about money. Make it about we, what you want together, and then what you need to do together financially to get there.

These are the times that will make or break your financial future. Understanding these financial rules and avoiding these money traps will put you out ahead of 90% of the people out there. Make sure to commit to that important money goal by writing it in the comments below and check out those other two videos in the financial planning series.