Use this retirement savings guide to get your planning on track and stop worrying about your nest egg

Everywhere you turn, it seems the news is reporting another scary retirement savings number and warning Americans of a coming calamity.

People aren’t saving enough, returns on retirement investments aren’t performing well enough or the cost of healthcare will bankrupt us all…it’s enough that many have given up on retirement planning altogether.

Retirement planning shouldn’t be something you avoid for fear of facing a harsh reality of missing your goals or fear that you’ll have to work longer. Planning for retirement should be something you look forward to every year, dreaming about what you’ll do and charting your course to get there.

It all starts with understanding what retirement means to you, what kind of income you’ll need and some simple steps to make your journey easier.

What is the Average Retirement Income?

While I’m not a fan of comparisons to the ‘average person’, it’s always good to know where you stand in your retirement readiness. Knowing that your retirement savings are way behind others can be the kick in the pants you need to start saving. Knowing you are on track can be just as useful, allowing you to relax a little and enjoy your money today.

A June 2015 study by the Government Accountability Office (GAO) found that the average American between the ages of 55 and 64 had $104,000 in retirement savings.

What kind of retirement income will that provide…not very much.

The rule of thumb is that you can safely withdraw 4% of your savings each year without fear of financial ruin over a 30-year period. That would mean just $347 a month for spending in retirement. Combined with an average monthly benefit of $1,365 from Social Security puts you at $20,500 or just barely above the federal poverty level.

Looking at average is misleading though because people that have saved millions make the average retirement savings much higher. Another study by the GAO found that nearly half (47%) of Americans had no retirement savings at all.

How Much Retirement Savings Will You Need?

I’m going to talk about the average retirement spending and average savings needed but remember that YOU need to know how much retirement savings YOU will need. It does no good to save according to the average if you end up needing more to enjoy your retirement.

Let’s look at the averages first and then I’ll offer some tips on customizing it for your retirement savings needs.

How much retirement savings a person needs comes down to their expenses, right? I see all kinds of estimates on how much you need based on current income but who cares about income, I want to know what my expenses will be and how much I need to cover them!

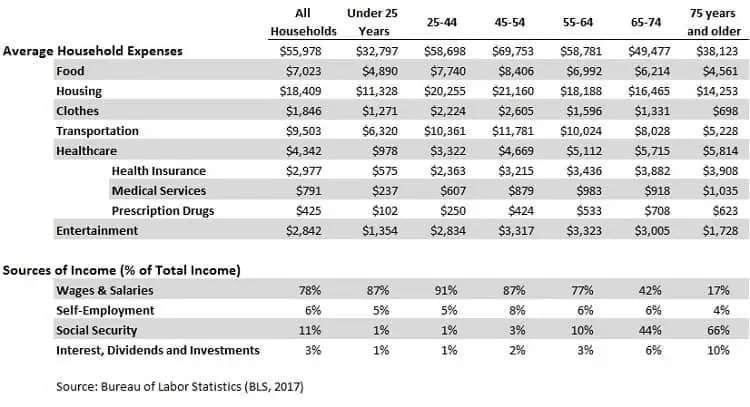

The Bureau of Labor Statistics (BLS) surveys household spending and reports it in the consumer expenditures report.

The average household 65 to 74 years of age includes two people and spends an average of $49,477 a year. That’s about $10,000 over our estimate of $20,500 in annual income you would have on the average savings plus social security.

There are a few points you should get from the table, besides the average people spend in retirement.

- Healthcare spending is the only reported expense that increases in retirement. In fact, it jumps almost 12% for people 65 and older.

- Wages and other work income still account for 21% of the income for people surveyed 75 and older. How many of these are working because they want to and how many are forced to work to pay the bills?

- Interest, dividends and investment income is just 10% of the total income for people 75 and older…instead they have to rely on social security for the vast majority of their income.

Finding the retirement savings needed is easy using the average spending from the survey. If you don’t want to have to work after age 65 then you’d have to replace the percentage from wages and self-employment income with money from interest, dividends and investments.

If the average annual spending for someone 65 – 74 years old is $49,477 and the average annual social security benefit is $16,380 then that leaves $41,828 (before taxes) to be made up through investment income.

If you safely withdraw 4% a year then you would need $1,045,705 in retirement savings to produce that $41,828 per year.

That simple calculation leaves a lot out though, like the fact that you’ll spend less as you age and you will earn money on your savings until you withdraw it.

Assuming a conservative 4.5% annual return on your remaining savings and the spending numbers above, you’d need at least $650,000 in retirement savings by age 65 to see your savings last to 100 years old.

That’s quite a bit above the $104,000 the average American has saved.

But is it YOUR retirement number?

Your retirement savings number needs to start from what retirement looks like for you. Use these tips to customize your magic number for retirement.

- What do you want to do in retirement and will it cost more or less than you are spending now?

- There are expenses you won’t have in retirement like saving for retirement or tuition, transportation to work and other spending that you can take off your current budget.

- Try estimating annual expenses for age 65 through 75 and then 75 and beyond. You’ll spend more those first ten years of retirement.

It’s up to you whether you deduct social security from your planned retirement expenses. Social security will surely be there when most of us retire though benefits may be lower than the average paid out now. Besides these cuts, you’ll also get more or less depending on when you retire.

If you can wait to retire at 70 years old, you’ll get much more per month ($1,686 a month for those born after 1960).

Planning my own retirement savings, I’m assuming my investments provide enough income until age 70 so I’m entitled to a larger SSI benefit but that the current benefit is reduced by 75% to $1,020 per month.

I would hope that the government doesn’t cut SSI benefits this drastically but I’d rather have more money than planned than have to make due with less.

Once you have an estimate for your annual retirement expenses, multiply that number by 20 for the amount you should have saved before retirement.

Some advisors recommend saving 25-times your estimated expenses. That would allow you to take out 4% a year for 25 years without accounting for returns. I’m not quite as concerned with having a lot of money left over for heirs so I plan on 20-times expenses but feel free to estimate higher if you want to leave a larger estate.

How Much Will You Spend on Healthcare in Retirement?

We saw how much the average person spends on healthcare by age but I wanted to revisit the subject because it’s so important.

If you’re under the age of 30, odds are you don’t realize how great it is to be healthy. As you get older, stuff starts breaking and aching. Being healthy and having the money to get the medical attention you need is a big part of being happy in retirement.

Fidelity estimated in 2016 that a couple will need $260,000 in savings to pay for healthcare in retirement. That’s 6% more than the prior year’s estimate and doesn’t include the $130,000 cost for long-term care insurance.

Now we estimated a total for retirement savings in the last section, enough to include healthcare spending, but Fidelity’s healthcare-only number is a good point to make as well.

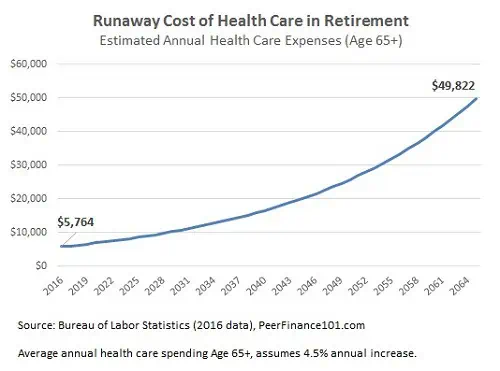

The average American spends just under $6,000 a year for healthcare through retirement. That $260,000 estimate might seem like more than is necessary but remember that healthcare expenses are growing at more than three-times the rate of other costs.

PwC estimates 2017 healthcare costs to increase 6.5% and the trend hasn’t slowed since 2014.

Let’s assume the increase in healthcare costs can be controlled to 4.5% a year…that would still mean average household health care costs in retirement balloon to $49,822 by 2064!

Suddenly, having $260,000 set aside for health care expenses doesn’t seem like an overly conservative number.

That’s all assuming that you are the ‘average’ person of average health and healthcare needs. That’s a pretty big assumption and brings us to our next section, healthcare insurance in retirement.

Understanding Retirement Healthcare Insurance

Asked why people continue to work well after their expected retirement age, health insurance is the #1 reason given. Paying for health care without insurance is out the question for many people and insurance is more than two-thirds total health care spending in retirement.

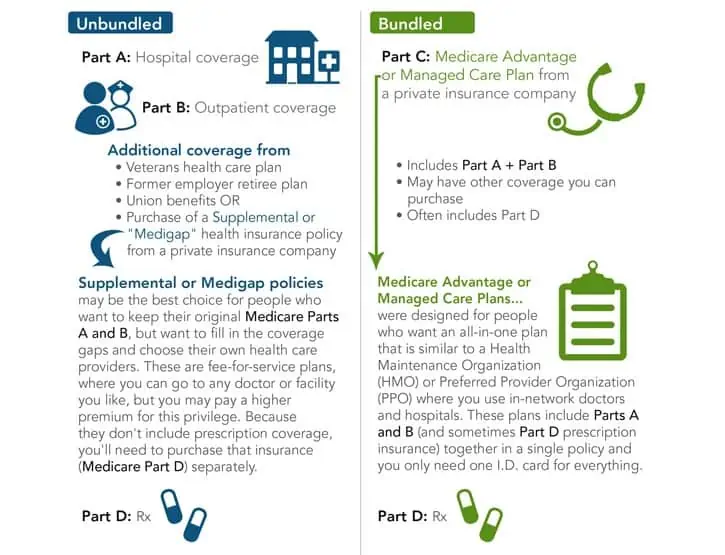

You qualify for Medicare at 65 but that only covers 64% of health care costs according to an estimate by the Employee Benefit Research Institute (EBRI). Private insurance and out-of-pocket expenses are still an important part of your retirement healthcare planning.

Another problem is that Medicare Part A, which is free, only covers some health care expenses. It doesn’t cover doctors’ services, outpatient care, or physical therapy. For these, Medicare Part B is available but is not free. You pay a monthly premium for Part B and there is no annual limit on out-of-pocket expenses as there is with private insurance.

Medicare Advantage, also known as Part C, is a private insurance plan that covers both Part A and B. These sometimes offer lower premiums and better benefits as a bundled policy but might restrict you to only the doctors and hospitals in the policy’s coverage.

As if that were not enough, Medicare Part D covers prescription drugs which are not normally covered in the other plans.

It can all be a little (or a lot) confusing. Just remember that you need coverage beyond basic Medicare to cover retirement health care costs. An insurance policy that covers Part B will pay for outpatient costs but you also need coverage for prescriptions.

Investing Your Retirement Savings

Now that we have an idea of how much retirement savings you’ll need and the importance of paying for retirement healthcare costs, it’s time to start thinking about how to grow your nest egg to meet those needs.

Investing is a personal process and must start with your retirement goals, tolerance for risk and ability to save. I see too many people shoot for a magic retirement number and an investment return goal with no relationship to what they want in retirement.

Like anyone with a destination but no idea how to get there, they end up going nowhere.

Knowing your estimated expenses and retirement savings needed to get you there is only part of the process. Putting together a customized investment plan will help you understand how to get there.

That road map to your financial destination is your asset allocation, the portion of your portfolio you invest in different asset classes like stocks, bonds and real estate.

The amount you invest in each of these asset classes will vary depending on your personal investment plan and with your age. You may start with a lot in stocks with the opportunity for higher returns but will shift to safety assets like bonds as you age to protect your retirement nest egg.

- The typical investor in their 20s generally should have around 60% in stocks, 15% in bonds, 10% in real estate and the remainder in other assets and cash.

- By their 30s and 40s, that allocation might shift to 55% stocks, 20% bonds, 10% real estate and the remainder in other assets and cash.

- Into their 50s, an investor’s focus starts to turn to protection of their retirement savings. Their investments might shift to 50% stocks, 25% bonds, 15% real estate and only 5% in other assets and the remainder in cash.

- By the time an investor reaches retirement, they might have just 30% in stocks with 40% in bonds, 15% in real estate and the rest in cash to pay for short-term expenses.

Keeping 30% of your retirement savings in stocks helps to protect your nest egg against inflation and provide a return. The 40% in bonds and the cash portion provide safety and spending money, especially for those years when stocks plunge and you need time to let prices recover.

An interesting way of investing retirement savings that I’ve been following is gradually overweighting the stock portion of your investments in health care companies. This means investing a greater portion of your money in drug makers, health care providers, equipment & service providers and life sciences.

These companies are set to benefit from increased health care spending from an aging population. As more people like you pay into these companies, their stock prices increase and potentially help your portfolio offset your rising health care expenses in retirement.

Among funds that invest across broad health care themes, consider:

- Health Care Select Sector SPDR (NYSE: XLV) invests across the entire health care sector.

- iShares US Medical Devices (NYSE: IHI) invests in companies that make medical equipment and devices.

- iShares US Pharmaceuticals (NYSE: IHE) invests in the largest drug companies in the United States.

Another retirement investing strategy that can help you manage your cash needs while still getting a sensible return is called the retirement bucket approach. It involves separating your retirement savings into three groups, each invested in assets that will provide varying levels of risk/return and cash flow.

What if Your Retirement Savings is Coming Up Short?

Retirement savings that are short of your goals isn’t the end of the world and it doesn’t mean you have to drastically cut your expectations for retirement.

There are five strategies to boost your retirement savings but you need to be proactive before it’s too late.

Step 1: Adjust your asset allocation on your retirement investments

I’ve seen a lot of investors put most of their retirement savings in ultra-safe bonds and even cash. They reason that they don’t want any risk with the money they’re depending on for retirement.

Unfortunately, they aren’t getting much return either.

As reckless as many investors are with their regular portfolio of stocks, they are often overly conservative when it comes to retirement investing. Overweighting bonds and relatively safe investments, even when you’ve got more than a decade to retirement, is going to make it very difficult to meet your investing goals.

Not having enough exposure to stocks puts your retirement investments at risk of loss to inflation, interest rate increases and just generally coming up short of your return goal. Revisit the asset allocation benchmarks above and consider shifting more of your money into stocks if you have more than a decade to retirement.

If you’ve got less than a decade to retirement or are not comfortable putting more of your retirement savings in stocks, consider investing in peer loans. Peer lending is the new asset class with safety of bonds but with higher returns. I’ve shifted some of my bond portfolio into peer loans on Lending Club and am averaging 7% a year in a tax-deferred IRA account.

Catch my interview with one peer lending investor earning 12% on his unique criteria for picking loans

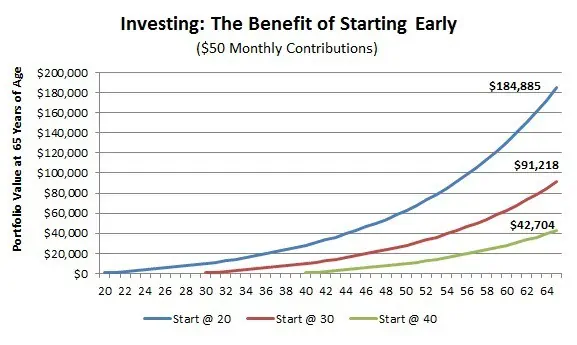

Step 2: Increase Retirement Savings Contributions

A little extra saved each month can go a long way when its compounded for years. Adding just $50 a month to your retirement contributions can grow to over $42,000 in 25 years. That’s an extra $27k beyond your contributions and can really make a difference when you’re trying to make ends meet in retirement.

It’s not just increasing retirement contributions but where you put them that matters.

Take full advantage of employer-sponsored retirement plans and other tax-advantaged saving. Getting a match on your 401k is like getting an instant return on top of the immediate tax deduction. It’s the easiest investment decision you’ll ever make and I’m always surprised at how many people don’t max out their allowable contributions.

You can contribute to both a 401k plan at work and an individual retirement account (IRA) so max out your annual contribution to each if you’re not already.

Step 3: Delaying Full Retirement

It may be time for a Baby Boomer Reality Check and the realization that retirement doesn’t come at 65 years of age anymore. Don’t worry Gen-X, your reality check is coming soon enough.

The Social Security Administration has gradually changed the age at which you can collect full retirement benefits as well as changing how much you get when you retire early or later. For anyone born after 1960, the age to collect full retirement benefits is now 67 years and that’s likely to change over the next decade.

Wait until 70 to start collecting benefits and you’ll get an extra 24% each month ($326) for the rest of your life. That doesn’t mean you have to wait until you’re a septuagenarian to start taking it easy but it will take planning.

If you can work part-time starting at age 65 or even 67, relying on investments to make up the difference in income, then you can hold off on collecting social security until you can max out the monthly benefit. Your retirement savings may decrease a little faster but that extra few hundred a month from SSI is guaranteed and for life.

Step 4: Annuitize Part of your Retirement Savings

A deferred annuity is a policy you buy today that guarantees payouts every month for the rest of your life and to start at a prescribed time in the future. Buying an annuity with a portion of your retirement savings can do two things for your retirement planning.

- Give you peace of mind, locking in a monthly income beyond social security

- Allow you to invest more aggressively with the rest of your retirement savings to potentially grow your nest egg faster

One of the biggest risks in retirement planning is that you’ll outlive your money. It’s called longevity risk and it’s a harsh wakeup to the 90-year old that has spent their retirement savings. An annuity addresses this risk by guaranteeing a set amount for life.

Combining an annuity with a guaranteed lifetime withdrawal benefit (GLWB) is a popular strategy called a Secured Income Strategy and can open up your options for the rest of your portfolio.

Step 5: Live Like a Retiree Today!

Retirees spend between 75% and 90% of their pre-retirement spending. Some of this is money saved from transportation to work and other work-related expenses but there are other places you can cut in your budget to save more money…and put it to work in your retirement savings.

A lot of people plan on downsizing to a smaller home or renting in retirement. Why wait?

Reevaluate how much home you truly need and consider downsizing five or ten years before retiring. Putting $35,000 from the sale of your home into an investment account at 60 will nearly double by the time you reach 70 years old assuming a 7% annual return. That can mean an extra $2,750 a year in retirement withdrawing just 4% annually.

Retirees also spend less on clothes and entertainment than their pre-retirement counterparts. That doesn’t mean you need to wear rags or deprive yourself of enjoying life. Take a look at your wardrobe and ask yourself if you really need the new designer fashions and consider lower-cost entertainment options.

Retirement planning doesn’t have to be something you avoid for fear of coming up short or having to reevaluate your retirement goals. In fact, planning for retirement can be exciting and something to which you look forward to doing every year. Keep an eye on your retirement savings and stay on track to enjoy life and the retirement you deserve!