Opportunity loans from OppLoans can help you get back on your feet and avoid the payday loan debt trap

I cover peer-to-peer lenders on the blog and have used p2p loans in the past. I’ve been burned by payday loans and recommend everyone avoid cash advance traps at all costs.

There’s one type of personal loan that I’ve almost completely missed in three years of blogging and five years as a financial planner.

Opportunity loans are a middle-ground between peer lending and payday loans, a way to get fast cash even on bad credit but without the debt trap that comes with payday lenders.

It wasn’t until a reader asked about a company called OppLoans that I knew the type of loan even existed.

Opportunity loans through OppLoans opens up a whole new option for bad credit borrowers with big advantages over payday lenders and a way to get your finances back on track.

Use this OppLoans review to help understand the process and get the best rate on your next loan.

What are Opportunity Loans?

Opportunity loans are exactly what they sound like, cash to give you the opportunity to get back on your feet when other lenders shut the door.

Most peer-to-peer lending sites I follow, even those offering bad credit loans, require a FICO credit score of 540 or higher. They pull your credit report and score during the application process and only higher credit scores get the best rates.

Anyone with loan defaults, bankruptcy or no credit score at all is usually locked out of p2p lending sites. That pushes a lot of borrowers into two-week cash advances with fees that amount to 500% annual interest.

When they can’t repay the full cash advance in two weeks, they’re forced to take another advance…and the never-ending cycle of debt begins.

Opportunity loans are like cash advances in that you only need a current income and a checking account to be approved for a loan. There is no credit check involved so the loans don’t hurt your credit score.

Unlike payday loans, opportunity loans are given on six to 36-month terms. That gives you longer to pay off the loan and usually lower payments so you aren’t forced into another loan just to pay off the old one.

Like any personal loan, you can use an opportunity loan for anything. The most common uses are for short-term cash needs like medical expenses, car repairs or just paying the bills when income comes up short.

Fill out an application and get your loan approved in 5 minutes – No credit check

What if You’re Turned Down by Other Opportunity Lenders?

If you have been turned down for opportunity loans in the past, consider financing with a company which provides no credit opportunity loans to people with bad credit and little or no financial history. If you are trying to obtain opportunity loan but your credit score is less than 700, you might try applying online for an opportunity loan through a company that is willing to work with those who may have an opportunity loan history that includes bankruptcies and other opportunity debt. By applying online for opportunity loans, you can bypass the opportunity lenders which only want to deal with people that are able to prove they are credit worthy opportunity borrowers.

When looking for how to get no credit opportunity loans, it is good to know that opportunity loans are available from opportunity loan companies that specialize in opportunity financing for people with no opportunity credit. If you don’t qualify for opportunity loans with the major opportunity lending institutions online, there still may be options open for you.

The first thing you will want to do when trying to find how to get opportunity loans with no credit is to apply for opportunity loans online. By doing so, you will be able to bypass the opportunity lenders that turn down people based on a bad opportunity loan history. When looking for opportunity financing options, it is necessary to find an opportunity lender that doesn’t require credit and financial information and reports from major opportunity. You need to find an opportunity lender that is willing to provide opportunity financing online without requiring or even requesting a credit report.

What is OppLoans?

OppLoans is the leader in opportunity loans. The company has been around since 2009 and has made over 100,000 loans already.

The company is the online platform for Opportunity Financial, a Chicago-based lender licensed to make loans in 18 states. The company offers opportunity loans on installment in 14 states and a line of credit in four others.

Since it offers opportunity loans, OppLoans requires no credit check and no FICO score.

OppLoans’ installment loans are available for up to $4,000 on terms up to 36 months. Cash is deposited directly in your checking account and usually available the day after your application. Rates start at 36% and payments start the month after your loan is created.

The OppLoan Line of Credit works like a credit card with an interest rate and an origination fee. You get approved for up to a certain amount and can borrow against it each month with a 4% minimum monthly payment on the balance.

How is OppLoans Different from P2P and Payday Lenders?

Opploans isn’t well known because it’s somewhere in the middle of peer-to-peer loans and payday lenders. The fact that the opportunity loans are only available in 18 states means most people don’t know they exist.

There’s a lot to like about OppLoans and if it is available in your state, it might just keep you from being a victim of payday lenders.

Opportunity loans have several advantages over peer lenders. There is no credit check so even borrowers with bad credit or no credit at all can get a loan. A loan from OppLoans won’t appear on your credit report and won’t hurt your credit score like a p2p loan.

The fact that opportunity loans are only available on six- to 36-month terms isn’t an issue for most borrowers. More than three-in-four peer lending borrowers opt for the 36-month payoff rather than the longer 60-month term.

While most peer lenders will loan up to $40,000 or more, the maximum you can borrow on OppLoans is $4,000 on each loan. The idea of an opportunity loan is just to get you quick cash to cover short-term needs, not for big projects.

The most obvious difference between OppLoans and payday lenders is the interest rate. Rates on OppLoans are still high, starting at 36% and as high as 160%, but that’s still less than half the rate on most cash advances.

How to Get an Opportunity Loan with No Credit Check

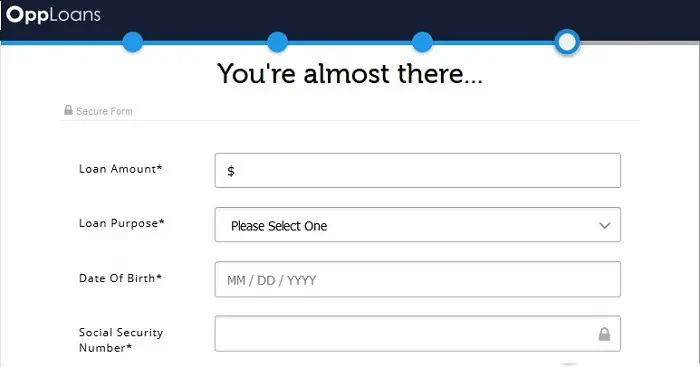

It took me less than five minutes to fill out online application on OppLoans. The entire process is just four steps.

There is no credit check for opportunity loans. The only requirement beyond being in a state where OppLoans operates is a current income and a checking account.

- Fill out your name and email address to create an account

- Enter address and contact information

- Enter employment information including monthly income and payment frequency

- Link your checking account to get your money deposited

That’s it. Since there is no credit check on the loans, your rate is determined by your monthly income and how long you want to pay it off. The application decision is made instantly and money is usually deposited in your account the next day.

OppLoans Review: The Good and the Bad

The most obvious drawback for OppLoans is the interest rate on loans. Most peer loans have a max rate around 36% even for borrowers with poor credit. While rates on opportunity loans are still way under what you’ll get from a payday lender, I still recommend trying for a peer-to-peer loan first to see if you can get a cheaper loan.

Click to check your rate on PersonalLoans – our top recommended personal loan provider

The other downside to OppLoans is that they are only available in a handful of states. Many states also have additional restrictions on the loans. When I looked up the company on BBB, this accounted for the majority of complaints.

Still, I was surprised at the company’s rating on the BBB website. Most payday lenders have extremely low customer approval ratings and even some peer lenders have a lot of complaints issued.

OppLoans has an A+ rating and just 36 negative reviews out of 241 total reviews. The positive reviews revolve around the company’s quick loan process and next-day funding.

While the interest rate on an opportunity loan is high, there are a lot of positives that come with the option.

It may be the only option for a lot of borrowers outside of expensive payday loans. More than 10% of Americans have a FICO score of 550 or lower. Americans 18-29 have an average credit score of just 630 FICO, well below the 688 national average.

Many of these borrowers are locked out of loans simply because they don’t have enough credit history.

An opportunity loan gives your fast cash with no credit check and longer to repay compared to other cash advance options.

OppLoans Review Summary

I’m glad a reader asked about OppLoans. After reviewing the company, I can say that OppLoans is a great alternative to payday loans or cash advances for people with bad credit. I still prefer peer loans if you can get approved but opportunity loans are your next step in getting the cash you need.

What I liked about OppLoans:

- Instant approval and no credit check

- No hidden fees and money deposited next day

- Up to 36 months to repay your loan

What I didn’t like about OppLoans:

- Higher rates compared to p2p lenders

- Origination fee on loans

Click to go to the OppLoans website and get your loan today

An opportunity loan is just that, an opportunity to get out from payday loans and get the money you need fast. OppLoans can fund your loan the next day and give you at six months or more to pay it off. I would still check to see if you can get approved at a lower rate on one of the peer lending sites but OppLoans is a great choice for people with bad credit or no credit at all.

Read the Entire How to Get a Loan Series

- How to Get Peer-to-Peer Online Loans with Bad Credit

- How to Get a Peer Loan on Bad Credit Now

- Is it Possible to Get Bad Credit Home Loans?

- How a Portfolio Loan Can Help You Get a Mortgage on Bad Credit

- 5 Websites to Get an Emergency Loan on Bad Credit