Cash advances and personal loans through p2p lending are entirely different. Understand the benefits and risks in each when you need fast cash.

Show of hands, who has been caught in the cash advance trap before? Yep, this guy right here.

I get a lot of questions about payday loans and cash advances, especially versus taking out personal loans through p2p lending sites. I’ve been a supporter of peer lending for debt consolidation and personal loans, especially since it helped me break the cycle of payday loan debt a few years back.

P2P personal loans helped me escape the cycle of high interest rates on cash advances. But I got a question recently from a reader that made me think again about the cash advance vs personal loans question.

Is there ever a time you would choose a cash advance over a personal loan?

How is a Peer to Peer Loan Different from a Cash Advance?

First we have to start with the questions, ‘What is a cash advance?’ and ‘What is a peer to peer personal loan?’

If you already feel like you know the difference between a payday loan and a p2p loan then you can skip ahead but there are some important differences that most people don’t know about.

Cash advances are very short-term loans, usually for one or two weeks. Technically, they aren’t even loans because they don’t charge an interest rate. This is how the cash advance people get around state laws on the max rate you can charge on a loan. Cash advances are also secured by a check or your payroll check which makes them different from p2p loans which are unsecured.

Cash advances charge a fee rather than an interest rate…but it’s the same thing. It’s just a way to trick borrowers because a $30 fee sounds much better than a 500% annual interest rate!

Peer to peer loans are true loans and charge an interest rate. Personal loans are not secured against any collateral but they do go on your credit report. That’s actually a good thing because it means that making monthly payments on your p2p loan will help boost your credit score.

Those are the main differences between a cash advance vs peer to peer loans.

- Cash advances charge a fee while p2p loans charge interest

- Cash advances are paid in a couple of weeks while p2p loans are paid over three years or more

- P2P loans go on your credit report, cash advances do not

- The total cost of a peer to peer loan is usually lower

On the surface, personal loans are great because they can be used for emergency expenses, only that it requires few days for approval. They come with low interest rates and fixed monthly payments. That way they are much better than getting cash advance, because you can get personal loans at a bigger amount. Anyway, deciding whether you’ll go for a personal loan or a cash advance still depends on how you will use the money and for what circumstance.

On the other hand, getting cash advance loans can be an advantage when it comes to processing time because they are usually processed more quickly than personal loans that require due process and may take a couple of days to get approved.

In a sense though, both are great options given that they are of short-term basis for smaller amounts, yet are both helpful in a way. Cash advance terms usually limits up to 62 days only while personal loans can be paid in installments for a year or two years maximum. In cash advance, you can acquire it without a credit check. It’s the opposite for the personal loan though which requires credit checks to get approved. Knowing these slight differences can help you decide which one to choose.

Why Choose Personal loans vs Cash Advances?

I actually thought once about buying a payday loan franchise when I was in my early 20s and wanted to reinvest some of the profits from my real estate investments. I looked up a few cash advance companies and the potential for returns but then decided against it when I saw what payday loans do to the majority of their customers.

Years later when I destroyed my credit and got caught in the cash advance trap, I’m glad I wasn’t a part of a business that uses people.

I wouldn’t say you should never use a cash advance. We’ll get into a circumstance where the cash advance vs p2p loan argument tips in favor of quick cash later. The super-high interest rate loans should be a last resort.

Cash advances are generally for between $100 and $1,000 depending on state regulations and are made for two weeks. The cost is between $15 to $30 on each $100 you borrow. If you convert that ‘fee’ into an interest rate, you’re paying between 400% and even up to 800% interest on an annual basis.

How is that legal when states are supposed to have usury laws to protect against predatory lending? It’s because the payday lenders charge a ‘fee’ for the loan instead of an interest rate.

The $30 fee may not seem like much if you just need a one-time loan to get you to your next payday but it adds up if you are constantly borrowing money every two weeks. Borrow just $400 each month and you’ll be paying more than $1,400 a year. It doesn’t seem like a big deal because the fee on each payday loan doesn’t seem very high.

But that’s where cash advance companies leave you. If you’re barely covering the bills now, how are you supposed to pay your bills plus pay a $30 fee every two weeks? The answer is you’ll need to reapply for a cash advance to cover the last one and pay another fee.

That’s why I say cash advances are the trap you never escape.

By comparison, personal loans through peer lending cost a fraction of what you’ll spend on payday loans. Personal loans through sites like Lending Club and PersonalLoans are made for terms of between three and five years at fixed interest rates. Rates are based on your credit score and generally range from 6% to 30% depending on your credit history.

You have fixed monthly payments just as you would on a traditional bank loan and can borrow from $1,000 up to $35,000 in as little as a few days.

So the reasons to choose a peer loan vs a cash advance should be obvious.

- Peer loans cost less in interest payments

- You can borrow more on a peer loan so you don’t have to keep borrowing money

- You have fixed payments and a longer time to repay peer loans

- Peer loans help build your credit score

There are borrower risks in peer lending such as using a peer loan for bad spending habits but the winner is fairly clear in the cash advance vs peer loans face-off. Interest rates on personal loans are a fraction of what you’ll pay on payday loans and the loan sizes are high enough that you won’t have to continuously come back for a new loan. Personal loans are a solution to your needs while payday loans are more of a quick fix.

I’ve reviewed the best peer to peer lending sites here with features on each personal loans website and rates but will list out a few of my favorite.

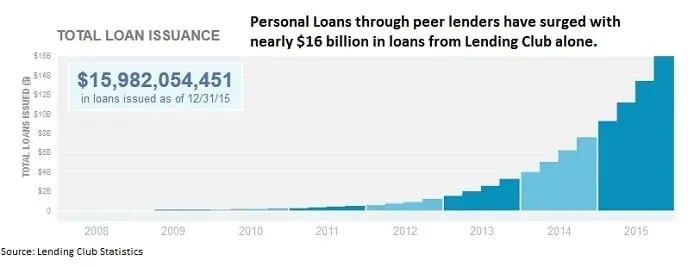

Lending Club is the largest p2p loan site and probably your best chance at lower rates if you have decent credit. The site also offers business loans but you can get up to $35,000 on a personal loan which is enough for most people. The credit score requirement is higher than most sites but it doesn’t hurt your credit score to apply. I’ve used Lending Club as a borrower and as an investor.

SoFi loans is another peer loans site but also does student loan refinancing and mortgage refinancing. It also offers very low interest rates for good credit borrowers but can be tricky to get approved if you have bad credit.

PersonalLoans is one of the best p2p lending sites for bad credit borrowers because it will accept applications from lower credit scores. Interest rates are still much lower versus cash advances and you can pay your loan off early without a penalty. I used Personal Loans when my credit score wasn’t approved on other peer loan sites.

Why Choose a Cash Advance vs Personal Loans

It’s pretty tough to find a reason why you would choose payday loans or cash advances vs personal loans but there are a few. It takes a lot of money discipline not to get caught in the cycle of needing to take out a new payday loan every few weeks so you really have to watch your spending.

This isn’t extra money but a quick advance on the money you’ve already got budgeted to pay the bills.

The major advantage of payday loans over personal loans is the speed at which you’ll get your money. Peer to peer loans are fast, usually taking about a week to get the money in your bank account, but cash advances are even faster and can get you cash in a day.

If you absolutely need the money by tomorrow to avoid a late payment hitting your credit and a late-fee, you might need to go with a payday loan.

If you’ve got bad credit, you might not have much choice in peer to peer lending. Lending Club requires borrowers to have a credit score of 640 or higher and even bad credit peer lenders like PersonalLoans require a score of 580 or higher. If you have a bankruptcy or something else on your credit report that’s keeping your score low, you may have to go with a payday loan for any cash needs.

Understand that a cash advance is your priority when it comes to paying off debt. Even though they don’t charge an interest rate, you should pay your payday loan off before making extra payments on any other credit. After you’ve paid off your loan, start working on an emergency fund so you don’t have to go back to the payday lender for more money.

Peer to Peer Loans Websites

I like the loan process on Personal Loans.com, which matches borrowers with lenders for the lowest rate available. Instead of the website or peer investors funding your loan, Personal Loans.com has a network of lenders that review each application and compete for your loan. Loans can be paid off over six to 72 months and to borrowers with a credit score of 600 or higher.

Get Low Rates and Up to $35,000 in a Few Days – Check Your Rate Now

Lending Club offers some of the lowest rates available among personal loan websites, with rates starting at 5.3% for good credit borrowers. The site charges between 1% and 5% of the loan amount and then offers your loan directly to investors. Investor demand for personal loans is so high that nearly all accepted loans get funded quickly and the cash will usually be in your bank account within a week.

Cash Advance Websites

Again, you should try peer to peer loans before you try getting a cash advance. If you can wait even a few days for the money, you could save hundreds or even thousands in fees.

Check into Cash is one of the largest cash advance providers offering payday loans and title loans. They have locations everywhere but have started lending online to make it easier for borrowers and you can do everything from your computer. The online application takes less than five minutes and you’ll get instant approval. You can usually borrow up to about $1,000 on your paycheck and can get money in less than 24 hours.

CashAdvance.com matches borrowers for loans of between $100 to $1,000 for terms of between seven days to a year. The company is one of the oldest in payday lenders, making loans available in 37 states since 1997. There are no credit requirements but borrowers must be 18 years old with a current job and at least $1,000 per month in after-tax income. If you are approved for a short-term loan, it will be deposited in your bank account within 24 hours.

CashAdvance.com – Get up to $1000 in Your Bank Account

The best use of a peer to peer loan is to pay off higher-rate debt or other emergency needs. While cash advances may be dangerous with extremely high rates, you might find a need in fast cash to avoid late charges on bills. Neither type of loan should be used to buy something you want or to pay off credit cards if you’re just going to max out your cards again.

If it’s possible, try giving yourself six months to improve your credit score before applying for a p2p loan for a better rate. Apply for only the amount you need to pay off other debts and pay off the personal loan as early as possible. We all need to borrow money sometime but knowing the advantages of peer to peer loans vs cash advances will help you avoid the traps.

Read the Entire Peer Loans Series

- The Ultimate List of Peer to Peer Lending Sites for 2020

- How to Get a Peer Loan on Bad Credit Now

- Should you Invest in Peer Loans or Lending Club Stock

- The Future of Peer Loans with Ron Suber, President of Prosper

- How to Get Peer-to-Peer Online Loans with Bad Credit