Understanding the different types of income and sources will help you choose the ones that fit best with your needs

You hear a lot about making a monthly income online, but I feel like it’s in a very shallow way. People talk about income sources as if they’re all the same instead of acknowledging there are different types of income.

Understanding the difference in income sources is critical to choosing the one that’s going to fit your personality and make the most money possible.

Beyond just finding that perfect fit, being able to combine some of these income ideas will help you create a consistent cash flow every month. While it would be more time than most people have available to try multiple business income ideas, you might easily be able to combine a side business with a passive income source and some investments.

Join Us for a Free 5-Day Build-a-Blog Course, Get Your Free Checklist and Video Course NOW!

I’ve interviewed six entrepreneurs, bloggers and investors and combined it with my own experience to put together this super-list of income ideas. Scroll through and add your own ideas in the comments section.

Jump to:

5 Sources of Investment Income

5 Types of Passive Income

5 Types of Business Income

5 Sources of Investment Income

Investment income is going to be the easiest to start of our three major types but it’s also the one that will probably earn the least amount of money…unless your name is Bill Gates.

Sometimes called portfolio income, this is the income you earn from price appreciation on investments and dividends or interest paid regularly. Of course, that means you need money to put down in the first place.

The amount of income you earn from investments is going to range from 4% to 20% and higher depending on the amount of risk you want to take. Reading through the sources for investment income below, remember that it’s a good idea to hold investments in multiple sources. This diversification will spread your risk around and help you smooth out your monthly income.

Before we look at those different types of income from investments, remember that you’re not going to see double-digit returns without double-digit risk. The higher the income, the higher the risk of loss. As you’re planning your investments, balance your need for income with your need for safety as well.

Real estate crowdfunding is the newest way to become a real estate mogul and beats some of the problems in traditional property investing. You buy a piece of a real estate project, for example a commercial property or an apartment complex, and platforms like Streitwise handle the payments between property managers and investors.

I’ve invested in real estate crowdfunding for just over two years and have found returns are between 9% for property loans and up to 20% on equity. That means between $900 and $2,000 a year on a $10,000 investment.

Real estate is the ultimate income investment with monthly cash flow and even a strong long-term appreciation. The great thing about this crowdfunding type of income is that you don’t need a huge down payment to get started.

Risks to real estate crowdfunding are going to be similar to traditional property investment including bad tenants and the economy. The upside is that you can invest as little as $1,000 in each property which makes it easier to buy several properties and diversify your risk.

Click to reserve your spot at the FREE YouTube Quick-start Webinar! I’m sharing three strategies that helped me grow my YouTube channel and double my business income. I guarantee they WILL work for you. Seats are limited for the webinar, so make sure you reserve yours.

Dividend stocks are my favorite source of investment income. As an equity analyst, I’ll always be investing in stocks, but I hate the constant roller-coaster ride of the stock market.

Dividend stocks not only provide that long-term potential for price return but put money in your pocket while you hold them. Research has shown that companies paying dividends consistently beat the rest of the market on total return and you can expect between 7% to 12% a year on your investment.

Dividend stocks are going to be one of the safest types of income we’ll talk about but also one of the lowest returns. For example, shares of AT&T pay one of the highest dividend yields among the mega-cap companies but even that’s only a 7% annual yield…well below the cash flow you’ll receive from some of these other income sources.

The most important thing to remember with dividend-yielding stocks is the trade-off between paying a dividend and keeping money back for growth. If a company is paying out a 6% dividend or higher, it’s not going to have a lot of cash for growth and your price return probably won’t be spectacular. That’s why I stick with companies that pay a yield between 3% to 5% and a payout ratio of 60% or less.

Peer-to-peer lending is another new type of investment income for me. I’ve been investing on Lending Club for three years and have earned a consistent 10% return on the loans.

P2P investing is nothing new. Banks always sell the loans they make to investors and your pension or insurance company likely holds a lot of these loans. P2P is different because you cut out the bank and the broker to invest in the loans directly.

You can invest as little as $25 in each loan that meets your criteria. Borrowers make payments every month to the p2p platform and those payments are split among the investors. You receive interest plus some of your investment back every month.

P2P is basically just bond investing except it’s to personal loans instead of to companies. Default rates on loans have been around 2% for my portfolio which I’ve managed through a special set of loan-picking criteria.

Robo-advisors are likely the most passive type of investing you’ll ever find and a great way to take the stress out of retirement planning.

A robo-advisor is just a stock investing account that does the investing for you. You open the account and answer basic questions on your goals and financial needs. The advisor runs on a computer program that matches you with investment funds to give you broad diversification and the return you need to reach your goals.

Costs on robo-advisors have come way down over just a few years and are generally less than 1% a year. You’ll earn stock market returns from 6% to 12% a year on your money without having to do anything more than make regular investments in the account.

Buying an existing business that cash flows is a mix of investment income and business income, but it can be more passive investment if you hire out management of the business.

You can do this with all the business income ideas we’ll talk about in the section below, but the difference is that you don’t have to put in the work to develop the business. How involved you want to be is up to you from managing the business on a daily basis to just receiving reports and cash flow from your managers.

The returns to this type of income can be high but so is the risk, including the risk of complete loss of your investment. Even if you plan on completely outsourcing management, I would recommend you only buy businesses in which you have a good understanding of the industry. That’s going to make it easier to manage your workers and hire for the different positions.

5 Passive Types of Income

Passive types of income are the most misunderstood and abused sources on the internet. Everyone loves the idea of earning an income without doing anything…and that brings out the scammers.

Also called residual income, this type of income is what you receive from things like rent and royalties on your past work.

Notice the word WORK there. Passive types of income almost always require some work on your part to get started. What separates them from the business income we’ll talk about in the next section is the amount of on-going work you have to put in to keep getting a check.

Self-publishing is by far my favorite passive income source but that might only be because it’s worked so well for me. If I was artistic in any way then maybe photography or painting would be my favorite.

I’ve enjoyed self-publishing so much because it fits naturally with my work as a blogger. I’m already creating hundreds of pages of content and it’s easy to repurpose some of that into a book.

Even if you’re not regularly writing, self-publishing can still be a great source of income. Books can be as short as 40 pages on Kindle (about 20 normal pages around 500 words each) and it’s easier than you think if you use a writing process to organize and stay on schedule.

I make just under $2,000 a month on ten published books, spending about $200 a month on marketing. That’s $180 a month for each book and you can produce three or four books a year if you’re really focused.

Click to reserve your spot at the FREE YouTube Quick-start Webinar! I’m sharing three strategies that helped me grow my YouTube channel and double my business income. I guarantee they WILL work for you. Seats are limited for the webinar, so make sure you reserve yours.

Create your account on TubeBuddy for free to see the features that will help grow your channel!

The best part about self-publishing is that it’s almost completely passive income once you’ve launched your book. Beyond the marketing dollars, I share my books on social media regularly but that’s it.

Being an artist doesn’t mean you have to be a Picasso to make a living. Websites like Patreon make it easy to get sponsors for your work and other sites help sell your photos and music.

I’m out of my element on this one but I know several people that make a great income on Patreon and by selling their art. I couldn’t decide whether to put this type of income here in passive sources or as business income below but there are definitely aspects of both.

If you’re creating something that will be used regularly like music or a photo, you can arrange to get residual income each time. On the other hand, other works like a painting will be sold once and you’ll have to keep producing to maintain your income.

Renting a room in your home isn’t going to be a passive income source you do forever but can be an easy way to make some money. It might not be something you make a lot of money from but it’s easily one of the most passive sources.

It’s been more than a decade since I’ve had roommates but at one point I rented out four rooms in a six-bedroom house for more than $2,000 a month. That was nearly twice the amount I was paying on the mortgage and it required no extra work on my part.

If you are considering renting a room, don’t skimp on the background check and keep high standards for roommates. It’s infinitely better to let a room sit vacant than to let someone in that’s going to be a nuisance or worse.

Cash back shopping is a controversial passive income source but one that requires no work and can be worth a few hundred a month if you use it correctly.

You use sites like Swagbucks to find rebate programs and cash back offers for things you were going to buy anyway. The website links directly to the retailer so you get all the offers and deals everyone else gets plus another 5% to 20% cash back.

The important reminder here is to not let cash back tempt you into spending more than you would otherwise. Getting that 15% cash back on a $100 coat still means it costs $85 and can seriously dent your budget.

Swagbucks Review – How to Get MORE Money!

House- or pet-sitting is one I’ve never tried but talked to a few friends to get their input for the article. I’ve always thought of it as more of an extra money idea but there are people that do this as their primary source of income.

The great thing about house-sitting is that you can combine it with your vacation plans so you don’t have to pay for a hotel. House-sitting pays between $25 to $45 per day depending on the city so it’s not something that will make you rich but you can easily combine it with a work from home business.

Pet-sitting takes a little more work and quite a bit more patience but can make more money. Sitters make between $45 to $65 per day and per pet. Dog walkers make between $15 to $25 an hour.

Some of these passive types of income are more ‘passive’ than others and you’ll have to work to set all of them up. The difference is in how much money you can make and how easy it is to keep that cash flowing.

Click to reserve your spot at the FREE YouTube Quick-start Webinar! I’m sharing three strategies that helped me grow my YouTube channel and double my business income. I guarantee they WILL work for you. Seats are limited for the webinar, so make sure you reserve yours.

5 Types of Business Income

Our last type of income is good ol’ fashioned business income but with a 21st century twist. I’ve included five ways to make money online, business ideas you can start in as little as five hours a week.

Blogging is one of the easiest business ideas to get started but will take time and quite a bit of work to start making a legitimate income. I was only making about $1,000 a month after six months of part-time blogging but have grown it to over $6,000 a month in a few years.

The upside is that it costs almost nothing to get started blogging, you really only need a hosting service like Blue Host which costs less than $5 a month. You can run your blog lean with few costs until you start making more money.

Affiliate marketing is usually best when used on a blog but you can make money through your social media accounts as well. Affiliate marketing is like advertising where you talk about a product or service and add a link to the company’s website. You then receive a commission if someone clicks through the link and buys the product.

Unlike advertising where you might only get a dollar if someone clicks on an ad, I know affiliates that pay up to $150 per commission. In fact, I make nearly half of my monthly income from affiliates through my blogs and other sites.

It helps to have a high amount of traffic to a blog or social media account because typically only a very small percentage of people will click through a link and then make a purchase. You can improve your conversion rate by sticking with affiliates that fit your audience more closely and by highlighting what you like about the product.

- Ultimate Guide to Affiliate Marketing for Bloggers

- Why Your Affiliate Conversions Suck and 7 Tricks that Work

Online courses feel like the next step in making money online. I know a lot of bloggers that have done very well with advertising, sponsored posts and affiliates but all those income sources require constant work.

Online courses are closer to the passive income idea because you can create a video course and then enroll students month-after-month. You might need to update the course every few years and there is some ongoing work with new students but it’s far more passive than most of the other online income sources.

Besides being more passive than other sources, you’ll make quite a bit more money on courses. Why settle for making a few dollars advertising someone else’s product on your blog when you can make hundreds for each student that buys your course.

YouTube is similar to blogging except in video format and it costs even less to get started. I love the opportunity to use YouTube as an income source but it’s probably not in the way you’re thinking.

Most people talk of YouTube income in terms of the advertising shown before and during videos. For video creators, YouTube will pay you about $0.004 per view if you allow ads to be shown on your videos. That means even YouTube stars with a million views a month are barely making enough to call it an income.

Making money on YouTube is about finding other ways to monetize your videos, through sponsors and your own products. For example, my channel got just over 100,000 views last month which would be all of about $400 in YouTube ads. Instead of relying on that ad revenue, I’ve made over $2,000 by getting a sponsor for three videos and adding Amazon affiliate links to some of my videos.

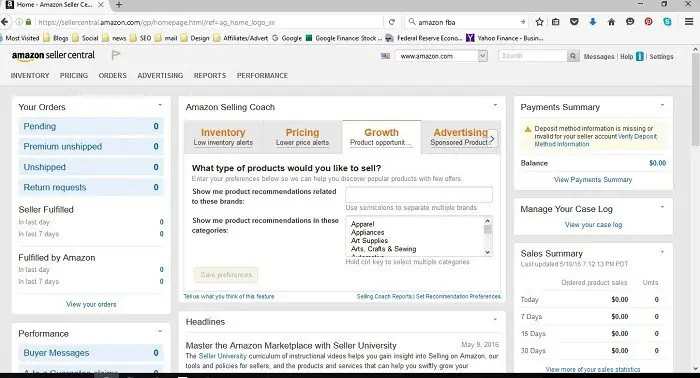

Amazon FBA is one of the most amazing income opportunities on the list but something most people aren’t using yet. The service allows you to create your own retail brand, your own product, and sell it just like any billion-dollar company.

I’ve just started exploring FBA as a personal income source and I’m really excited to build this out. It’s never been easier to sell a product online and the income potential is amazing.

Here’s an example, say you want to have your own line of blue jeans to compete with Levi’s. You contract with a manufacturer, usually a Chinese company through Alibaba, and design your own label. The manufacturer ships your product directly to Amazon warehouses. When you get an order on your Amazon page, the order is shipped directly to the customer.

With Amazon FBA, you don’t need any logistics or warehousing. You don’t need the hundreds of thousands it used to cost to start production or marketing a national brand. In fact, I’ve seen people start with as little as $4,000 in marketing and for an initial order from the manufacturer.

How are Types of Income Taxed?

Taxes are something most people don’t think about until it’s too late. They realize in April that they owe thousands to the government, can’t cover the bill and end up paying a penalty and interest.

How your income is taxed and when it’s due is going to depend on the type of income.

Taxes on business income will depend on your personal income tax rate if you operate as a sole proprietorship. You’ll need to estimate your tax bill for the business and make payments every three months.

If you operate your business as a corporation or partnership, you’ll pay taxes on the amount paid as salary and estimated quarterly taxes on profits.

Investment income is taxed as either capital gains, the profit on your investment, or along with your income taxes. Generally, if you hold an investment for more than a year then any money you make above the cost is taxed at the special long-term capital gains rate.

If you hold an investment for less than a year, the profits are generally taxed along with your income and usually at higher rates. Other types of investment income like dividends may be taxed on long-term rates if you hold the stock for a certain period around the dividend payment.

Taxes on passive income will depend on the type of income and how much work you put into it over the year. Most of the passive income ideas here are taxed as if they are business income because you still have to put some work into keeping the income steady. It’s important to understand the IRS rules around passive activity and whether your income is considered an investment or a business.

You’ll notice that almost all these types of income require some kind of work or investment to get started. I hate the promises of passive income online because very few are as passive as you’re led to believe. Understanding that will help you choose which of the different type of income source is best for your goals and your time constraints. Think about the income ideas and consider starting slow in more than one to see which you enjoy best.