The ultimate list of how to borrow money that won’t put you in debt the rest of your life

We’ve all been there. The car breaks down and the $400 to replace the air flow sensors just isn’t there. You need to borrow money to get it fixed…fast.

Now isn’t the time for a sermon about saving money for a rainy day. You don’t need speeches, you need solutions. You need a way to borrow money that’s not going to put you in debt for the rest of your life.

I’ve compiled this list of ways to borrow money as a guide for all the ways you might consider but not all are created equal. I’ll start with a few of the preferred methods for getting quick cash and a few that I’ve used. I’ll also include a few of the riskier ways to get money as well as the four popular ways you should think twice before using.

Good Reasons to Borrow Money

I feel like I should start out with a disclaimer or risk getting my ‘good financial blogger’ license revoked. I’m not the anti-debt blogger you see on most websites, the guy that is going to tell you never borrow a dime even if it’s a matter of life-or-death.

I believe there are two very good reasons to borrow money.

- As part of a business strategy, borrowing to invest in the business, earning a much higher return than the interest rate on debt.

- When you have a large, unexpected emergency expense that needs paid fast.

So we’re not talking about seeing the new iPhone come out and you absolutely got to have it.

We’re also not talking about borrowing to pay for things you need to buy on a regular basis. If you’re borrowing to pay for groceries, it’s a sign of a bigger problem that isn’t going to be fixed by borrowing the money just this one time. Borrowing to pay for regular living expenses is only going to end up in bankruptcy.

OK, disclaimer done. Let’s look at those 15 ideas on how to borrow money.

Ways to Borrow Money Fast

When you need to borrow money, usually it’s something you need RIGHT NOW! It’s an emergency expense that needs paid today or tomorrow.

Religious and non-profit organizations are one of the fastest ways to get a little extra cash or help with must-have items. We’re not talking about a lot of money, maybe $50 at most, but that can be enough to free up room in your budget. Some of these organizations won’t give you cash but will give you things like groceries or household items, enough to free up space in your budget to pay for your emergency expense.

The website Guidestar.org has a directory of religious and non-profit organizations you can contact to see if they offer assistance. You can also try the Red Cross, Catholic Charities and the Lutheran Services in America.

Friends and family is always a tough one when talking about borrowing money. It’s one of the fastest and best sources…but also one that most people don’t want to use.

Understand that we all get in these situations once in a while and (mostly) family is there to help each other. You might not care for Uncle Earl any more than you care for gum stuck on the sidewalk, but there’s usually a few people in the family you would gladly help out.

If you’re going to borrow money from family, make absolutely sure you need it and can pay it back. Consider offering some kind of interest, even if it’s only a low rate or the offer to do something for them while you repay the loan. There are 14 other options to borrowing money here, you don’t want to ruin a family relationship by not repaying a loan.

- Put the loan in writing, down to how much you’ll repay and how long it will take.

- Put the payment on your list of regular bills to pay. Don’t treat it as something you pay ‘if and when you feel like it.’

- Don’t avoid the person while you’re repaying the loan. They’re still family.

Peer to peer loans are a new way to borrow money and work through online sites set up for the purpose. These websites connect investors with borrowers. A borrower applies for a loan and agrees to make monthly payments with interest. The investors provide the funds and get their share of the payments deposited in their account each month.

P2P loans are unsecured meaning you don’t have to put up your house or car as collateral. For this reason, the interest rate is usually a little higher than a traditional bank loan and averages around 14% a year. The upside is that these loans are usually much easier to get than a bank loan because investors need to do something with their money.

I’ve used Lending Club both as an investor and a borrower. Within the peer-to-peer loan space, there’s also SoFi and Upstart.

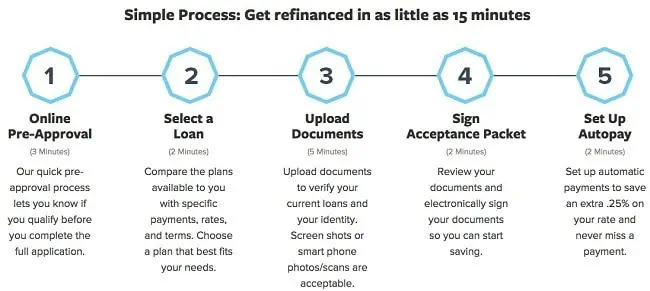

Personal loans are similar to p2p loans but easier to get. These are also unsecured loans but usually through an online lender rather than directly from investors. Personal loans are available to borrowers with credit scores well below what would be approved by a bank or even a peer-to-peer site.

Personal loans work just like any other loan. You apply on an online lender and get an instant decision as well as the loan rate. You can usually borrow up to $35,000 and pay the loan back in three- or five-years. If you agree to the loan, you get money deposited in your account within a day or two and start making payments next month.

I’ve used several personal loan sites, both for quick cash needs and to review for the blogs. The first I used was PersonalLoans for debt consolidation and later for a home repair loan. I’ve also used BadCreditLoans, which is a website that specializes in loans to borrowers with extremely low credit scores.

The thing to remember when deciding on a peer-to-peer or personal loan is that it doesn’t hurt to apply on a few different websites at once. It won’t affect your credit score until you accept a loan and you’ll be able to shop your loan around to make sure you get the best rate available.

- Borrow only as much as you need. Lower loan amounts will mean lower rates.

- Borrow for the shortest term you can afford. Loans for two- or three- years will offer lower rates compared to five-year loans.

Check your rate on a personal loan up to $35,000 – instant approval

Ways to Borrow Money Online

Most of the ideas in this list will be through an online process but I wanted to highlight some of the ways you might not know yet. The internet revolution has opened up a world of options but there are a few warnings that you’ll need to watch for in getting a loan.

- Never accept a loan through an email

- Don’t click on a link in an email promising a loan. Always go directly to the lender website through a Google search instead. That email link could be a virus or a loan scam.

- Always check to make sure the lender is registered to do business in your state.

Margin lending is a low-cost way to borrow money for anyone with investments. Most investing platforms will lend you up to a third of your account value to take as cash or reinvest in more stocks.

This type of loan usually doesn’t require monthly payments but there is an interest rate associated with the money. The rate is generally non-fixed, meaning it moves up or down according to a benchmark rate like LIBOR.

For example, rates on my ETrade account start around 7% for borrowing against accounts with a value in the millions but are as high as 11% a year for smaller accounts. Rates on my M1 Finance account are as low as 4% for small accounts but you need to have at least $10,000 invested.

Margin borrowing is risky whether you’re taking the cash or using it to reinvest in stocks. You still owe the money borrowed if stock prices fall and you might have to deposit more money to keep your account in good standing.

Credit cards cash advance is one of the most frequently used ways to get cash quick but it comes with a few surprises. You can usually go to a bank or ATM and use your credit card to get cash, adding to your card balance and paying it back monthly.

The problem is the interest rate on cash advances is usually much higher than on regular purchases. This is something most people don’t realize until they see their first bill. Even if you’ve got a low introductory rate on your new credit card, the cash advance rate may still be 24% or higher.

Cash advances on your cards are easy to get and nearly instant but the rate is so high that you might consider one of the other methods first.

Balance transfer from existing cards to new credit is one that most people don’t think about but can be a cheap way to free up space in your budget.

The idea here is that you open a new credit card account with a low or zero-percent rate on balance transfers. Then you transfer your balance from other credit cards onto the new card. This gives you space to charge on the older cards and free up cash to spend on your emergency expenses.

You might not realize how risky this strategy is though until it’s too late. Opening that new credit account is too much temptation for a lot of people. You’ve not got another few thousand you can charge…whether you need it or not.

- Always try to pay your credit balance in full each month to avoid interest charges

- Pay off your balance transfers within the introductory period or you’ll owe all the interest that would have been accrued

- Consider using your credit card only for emergency purposes and using cash for all other spending

A signature loan from the bank is similar to a personal loan, unsecured credit where you don’t need your house or car as collateral. These are generally more difficult to get than a p2p or a personal loan because of bank standards in lending.

Most traditional banks require a 720 FICO or higher for personal loans and you’ll need an account open for more than a year before applying. There isn’t much difference in interest rates between banks and personal loan sites for borrowers with good credit. Bank loans will take from 24 to 72 hours to process your application and get the money so most of the time, it’s easier just to try the online lenders.

HELOC stands for Home Equity Line of Credit and is like taking out a credit card on the value of your home. This means you’ll need to own your home and owe less than the value.

The bank approves you for a line of credit up to a certain amount, usually a few thousand dollars. This becomes like a checking account you can take money out of whenever you like but that charges an interest rate on whatever you borrow. You can pay some back and borrow some whenever you need.

If you can get approved, HELOC loans are generally lower interest rate compared to other loans because they are secured against your home. If you fail to make monthly payments, the bank can put a lien on your house or start foreclosure proceedings.

Refinancing or taking a 2nd mortgage on your home is similar to the HELOC in that you take a loan out secured by the value of your home. These are more like traditional loans though where you borrow a lump sum and pay it back in fixed monthly payments.

Refinancing or taking out a second mortgage is generally going to be some of the lowest rates available but also comes with the risk of losing your home if you can’t make payments. It’s also not an option for anyone renting instead of buying.

Life insurance cash value on a whole life plan is another popular way to get fast cash but one not usually available to most people when they need it.

When you start paying premiums on a whole life or universal insurance policy, a cash value builds and accrues interest. You can borrow on this cash value at no interest and it won’t affect your insurance policy.

The problem with these types of policies is they are incredibly expensive. The premiums on a whole life policy can be two- or three-times what they would be on a similar term life insurance policy. Much of the extra premium you pay goes to paying the sales agent and not to increase your cash value.

Another problem is that the cash value account earns a very low interest rate, generally just over the savings rate at a traditional bank. A better option would be just to go with the less expensive term life policy and invest the difference in premiums into an account. This gives you the same insurance coverage and a higher return on your money at the same time.

Ways to Borrow Money You Don’t Want to Use

There are a few ways to borrow money that should be your absolutely last resort. I struggle to even include them in this list but wanted to give you all options available.

These four ways to get quick cash may be some of the fastest and easiest but they have hidden risks that could trap you in debt for the rest of your life! Use them only in emergencies and when you have no other choice!

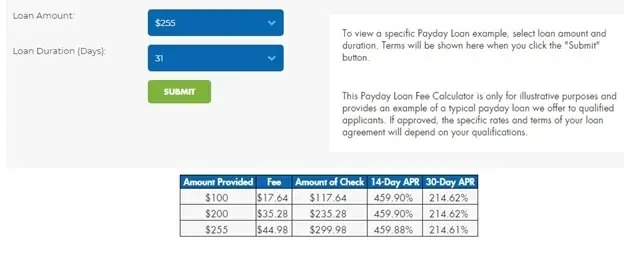

Payday loans are small loans from an online lender or local payday store. Most are only available up to $1,000 and charge a fee of $15 for every $100 borrowed. The benefit is they are quick and easy to get, usually only requiring a part-time job and checking account.

These are some of the most dangerous loans you can get for several reasons:

- The maximum amount usually isn’t enough to do more than just get you over the next two weeks. The full amount is usually due in the next pay period. That means you’re right back to borrowing another $1,000 to pay off the loan and keep from drowning in 14 days.

- That $15 per $100 fee might not sound like much but it’s equal to an interest rate around 500% when you look at it on an annual basis. It adds up fast when you have to return for a new loan every few weeks.

- Payments on the loan will be taken automatically from your checking account and will mean NSF fees if you don’t have money available.

Check advances are similar to payday loans with a slight difference. With a check advance, you write a check to the lender and they give you cash. The lender then agrees not to cash the check on your account until a set date, usually your next payday.

These check advances come with the same fees and risks as a payday loan. The base fee amount is misleading and very expensive. You’ll also usually be limited to advancing only as much as your next paycheck so the maximum you can borrow is too low to pay for many emergency expenses.

Auto title loans are like refinancing your home but with some additional risks and costs. These are generally available through a bank or used car company. The lender will give you cash for a loan on your car, up to a certain percentage of the value.

Title loans charge a much higher rate than the home loan options we talked about, usually starting at 18% or higher. Payments may not be a problem because the loan payoff can be stretched over five years but the amount you end up paying in interest will be in the thousands.

While much better than a cash advance or payday loan, you’re much better off looking for a p2p or personal loan than taking a title loan against your car. Rates will be the same and you won’t have to worry about losing your car if you miss a payment.

401k loans are a tough one, and one where many bloggers will disagree with me. This is a loan on the cash value of your 401K savings. You pay back the money with interest but the interest goes back into your account so you’re basically paying yourself.

That might seem like a sweet deal but there are some risks to consider in borrowing on your 401K:

- Many plans will not allow you to contribute to your account while repaying a loan. That means you lose the benefits of company match and tax-deferred saving.

- If you can’t repay the loan, it becomes a withdrawal which means you’ll pay a penalty and the taxes on the money.

- If you leave your job, you might have to repay the loan immediately which could trigger the withdrawal penalties if you can’t repay.

- It sets a bad habit of borrowing on the money that is meant for your retirement. Do this too often and you won’t have anything saved.

“Life is what happens when you are busy making other plans.” The quote from John Lennon is just as true in your personal finances as it is in general. Emergency expenses have a way of popping up when we’re least prepared. That means knowing the ways to borrow money and understanding the risks in each. Keep this list handy for when you need it most.