These three retirement investing strategies will make your money go farther and guarantee income

Most Americans face a tragic tug-of-war in retirement, pay for living expenses or grow their savings so it lasts through retirement.

According to the Government Accountability Office (GAO), the median retirement savings for Americans in their 60s is just $148,000 including employer-sponsored and individual plans. That’s enough to provide about $493 a month without withdrawing so much that the investments run out before an 85-year life expectancy.

Even with Social Security benefits averaging $1,360 before taxes, that’s nowhere near enough to pay for living expenses.

Another survey, the Department of Labor’s Consumer Spending Survey, reports that retirees spend an average of $44,500 a year on living expenses. For a single individual, that leaves a gap of over $22,000 between SSI benefits and investment income. Even for a couple receiving two SSI benefits, the expenses gap is nearly $10,000 a year.

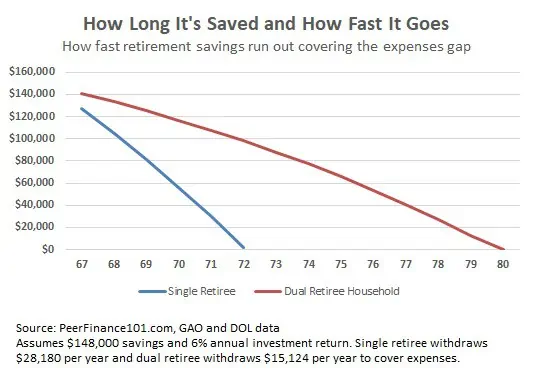

So you’re forced to withdraw more from your retirement savings than is recommended. The graph below shows how long $148,000 in savings lasts when an individual and a retired couple are forced to make up the difference between SSI benefits and expenses by withdrawing on their nest egg.

Even earning a solid 6% annual investment return, a strong return on a retirement portfolio, the single retiree runs out of money within six years of retirement. The retired couple does only marginally better, making their money last until just before their 80th birthdays.

With the average life expectancy of a 67-year old reaching 84-years old, none of these scenarios is good. You either live on next to nothing or you run out of money early…and live on next to nothing.

Fortunately, there are three retirement investing strategies you can use that will help cover your living expenses and make your money last. They aren’t miracle cures for not having saved enough but they do work and will help you enjoy the retirement you deserve.

This is the last in our seven-part series on life-long investing. We started with how to create your own personal investment goals and understand your investor type. Throughout the series, I’ve shown you exactly how your investments change as you age, how you can keep your portfolio matched to your needs and how to keep your retirement on track.

Check out the other articles in the series:

- Use this introduction to create your investment goals and understand your investor type

- Find the perfect portfolio for investors in their 20s

- See how you can invest in your 30s for the right amount of risk and return

- Learn how your investment needs start changing in your 40s

- Find out how to invest in your 50s to balance both safety and growth

- Protect your investments with these pre-retirement tips

In this article, we’ll first look at the unique challenges facing retiree investors and how to protect your money while trying to make it last. I’ll also detail those three retirement investing strategies that help you enjoy your savings without worrying if your retirement will put you in the poorhouse.

Investing Questions in Retirement

While your investing strategy before retirement was based on a list of factors from age to risk tolerance and taxes, investing during retirement comes down to one very important question.

How do you protect the money you’ve saved but still grow it so you don’t run out?

Answering this most important retirement question means a delicate balance between the safety and cash flow of bonds with upside growth but risk in stocks and real estate investments. In prior articles, I’ve created three example portfolios of these three asset classes for different investor types.

For retired investors, putting together your investment portfolio isn’t as easy as aiming for a level of risk and return. You have to look at how much money you’ll need to withdraw each year and how to meet that need while still investing for growth.

That means I can’t tell you what percentage of your investments should be in bonds, real estate or stocks. Your perfect portfolio is the one that meets your specific retirement income needs while still growing your money.

Fortunately, there are several strategies you can use to manage your retirement money. The three retirement investing strategies below will help you pay for living expenses while making sure your money lasts through retirement.

Best Investing Strategies for Retirees

All three of these strategies will help you balance the need for growth while spending down your retirement investments. Which strategy you choose depends on personal preference and your tolerance for risk but either of the three will accomplish the same goal.

The Bucket Approach is one of the most popular retirement investing strategies, recommended by people like Dave Ramsey and other professionals. The idea is that you set up your total investments in three accounts, each with different investments, to provide for cash flow and growth.

The first account is invested in money market investments and very short-term bonds. The goal for this portion of your investments isn’t to earn a return but to provide cash for living expenses. You might earn enough to cover the rate of inflation but you’re spending this account down within a year or two.

The second account includes longer-term bonds, with maturities of five years or less, stocks from income-producing sectors like utilities and consumer staples and some real estate. The goal for this account is to produce cash to refill the first bucket.

The final account includes investments in stocks and high-yield bonds for growth. The goal for this bucket is to produce a return that will keep your nest egg growing even as you spend down your other accounts. Understand that this doesn’t mean you’re investing in penny stocks or other high-risk investments. You want to invest this bucket in a diversified mix of stocks and bonds from large companies.

To construct a bucket approach retirement portfolio:

- Put 18 to 24 months’ worth of expenses in your ‘cash’ bucket and invest it in short-term investments like money market and bonds maturing within a year. Your goal is to have cash available to withdraw each month while earning a return of around 1% or 2% to cover loss to inflation.

- Put another three- to five-years’ worth of expenses in your ‘income’ bucket and invest it in investment grade bonds of high-quality companies. Bonds should have maturities of between three- to ten-years. You might also consider 20% of your money in this bucket in the Vanguard Real Estate Fund (VNQ) for cash flow. Your return goal for this bucket is between 3% to 5% annually.

- Every six months to a year, move the cash produced from your income bucket to refill your ‘cash’ bucket. You might need to use some of the money from maturing bonds to refill your cash bucket completely each year.

- Put the remainder of your retirement portfolio in your ‘growth’ bucket, invested in a broad market fund in U.S. and foreign stocks.

- During years when the stock market rises, you can use gains from your growth bucket to refill your income bucket.

The bucket system of retirement investing plans the cash you need to pay for expenses while protecting your portfolio from market crashes. Your cash and income buckets are large enough that you shouldn’t need to touch your growth bucket during years when the stock market falls.

In the event of a stock market crash, you’ll have enough in your cash and income buckets that you can spend them down while you wait a couple of years to let stock prices recover.

Here’s an example of what your portfolio might look like using the bucket approach to retirement investing. The percentages in each investment within each bucket are approximate values. The actual amount you invest in each will depend on your total investments and how much you need to produce a return that will pay living expenses.

You might consider adding some real estate investments to your growth bucket as well to further spread risk out of stocks and produce good cash flow. If you don’t have enough saved to cover five years’ expenses, you might reduce the amount in each bucket but I wouldn’t recommend having less than one year’s expenses in your cash bucket and two year’s expenses in the income bucket.

The Matching Strategy for retirement investing is slightly more conservative than the bucket approach. This strategy directly matches your living expenses with fixed-income investments to virtually guarantee you have enough to pay for retirement.

- Start by planning your living expenses for each year through your retirement. You can add 2% to the amount each year to estimate increasing expenses with inflation.

- Reduce your estimated expenses for each year by the amount you expect to get from Social Security. The average amount collected per month is $1,360 but will depend on how many years you worked and how much you paid into the system. Increase this amount each year by inflation as well.

- The difference between expenses and social security each year is the amount you’ll need to make up with investment income.

- Start by buying your second year’s worth of expenses in one-year corporate bonds. The maturity of those bonds in a year will return your investment and pay for your second year’s expenses.

- Buy your third year’s worth of expenses in two-year corporate bonds. The maturity of those bonds in two years will pay for your third year’s retirement expenses.

- Do this for every year’s worth of expenses out to five years’ into the future.

- Invest the rest of your portfolio in a diversified portfolio of stocks and real estate.

- Each year, buy another year’s worth of expenses in five-year bonds to keep your expenses matched for the next five years.

The interest you receive on your bonds can help pay for unexpected expenses or you can put them back into your stock portfolio to help keep it from running out. You’ll earn about 2.25% return on your bonds and 7% or better on your stock portfolio.

This strategy also helps to withstand stock market crashes. You always have five years’ worth of expenses covered with the safety of bonds. In the event stock prices tumble, you can wait a couple of years to rematch your expenses with bonds to let stocks recover.

The matching strategy for retirement investing might look something like:

Bonds can be a mix of investment grade corporate bonds with A- to AAA ratings. Your stock portfolio can be a mix of the total market U.S. fund and real estate investment trust.

If you’re having trouble meeting your expected expenses, you can probably reduce your living expenses a little each year and still be safe. The Department of Labor’s consumer spending survey shows that retirees’ expenses fall gradually through retirement. You might start retirement with lots of travel plans and activities but most people spend far less as they get older. Instead of increasing your estimated living expenses for inflation each year, keeping the amount consistent will mean gradually spending less each year.

The final retirement investment strategy is to use annuities to cover a portion of your expenses along with social security and then filling the gap with a return from stocks.

Annuities are investment products sold by life insurance companies, an investment with a guaranteed payout. For an investment today, the insurance company promises to pay you a set amount every year for the rest of your life and sometimes to pay a survivor’s benefit to your spouse. Payments can start immediately or at some point in the future.

- Estimate your annual living expenses in retirement and reduce that amount by expected social security benefits. Social security pays approximately $27,500 after taxes for a couple or just under $14,000 for an individual, on average.

- That leaves approximately $14,500 in living expenses to cover for a retired couple spending $42,000 a year.

- Costs for annuities vary by state but, on average, a 65-year old male can get a $9,000 annual payout for a one-time payment of $200,000

- The rest of your annual living expenses are covered by returns from an investment portfolio

The guaranteed income from the annuity means you can take a little more risk in your stock portfolio for a little higher return. Holding just a few years’ worth of expenses in bonds gives you more than enough money to wait out a stock market crash. You also need to withdraw much less from your investment portfolio to make up for remaining expenses not covered by the annuity and social security.

The downside to annuities is that they can be expensive and may not necessarily guarantee the income. The return you are actually getting on your money when you buy an annuity is usually between 2% and 4%, much less than you could get on a diversified portfolio. You pay for the safety of the guarantee.

While most insurance companies are extremely strong financially, a bankruptcy could put your annuity at risk. You probably won’t be totally wiped out because your annuity will get paid out of the company’s remaining assets before other creditors.

Of the three retirement investing strategies, I like the bucket approach best but more conservative investors may prefer the matching strategy. That’s not to say you can’t use an annuity in these first two strategies to provide even more safety with a guaranteed income.

How to Manage Your Retirement Investment Withdrawals

For most investors, withdrawing from their retirement accounts will be based on how much money they need for expenses. With just $150,000 in the median retirement account and around $10,000 or more needed each year for living expenses, most investors withdraw more than is required each year.

Required withdrawals? Yep, the government requires you start taking distributions from your 401k or individual retirement accounts (IRAs) when you turn 70 ½ years of age.

Fail to withdraw at least a minimum amount from these accounts and it could cost you thousands in penalties.

The following graph will help you determine the minimum amount you must withdraw each year from your 401k or IRA money.

For example, if you had $200,000 in a retirement account as of the end of last year and turn 74 this year, you need to withdraw at least $8,404 this year or pay the penalty. That’s $200,000 divided by 23.8

Note that this doesn’t include Roth IRA plans, which have no required minimum distributions. You can keep your money in a Roth account for as long as you like and even pass it on to your heirs tax-free.

All this sets up some important rules for how you withdraw your retirement money to get the most out of it. Strategically withdrawing your money can help you save on taxes and get the highest return possible.

- Make your required minimum distributions (RMDs) first to avoid penalties.

- Sell investments from any regular (non-retirement) investment accounts before other IRA or 401k distributions. If you are in the 15% tax bracket, you may not have to pay capital gains tax on these withdrawals. Even if you have to pay capital gains taxes, it’s usually lower than your income tax bracket.

- Withdrawals from a traditional IRA or 401k are counted as income and will be taxed at your highest income tax bracket. If you need more money to pay for living expenses, withdraw enough to push you up to the next tax bracket but not into it. Then consider withdrawing the remainder of expenses from your Roth IRA which comes out tax-free.

- High income retirees should consider withdrawing from their Roth IRA accounts first and only taking the required minimum distribution from their other retirement accounts. This will help keep your taxable income lower for as long as possible.

Use cash from bond investments or sell bonds to pay for living expenses. In years of stock market gains, use some of those returns to buy more bonds and refill the bond portion of your portfolio. If you keep at least a few years’ worth of expenses in bonds, you can ride out any stock market weakness.

This retirement withdrawal strategy keeps money in your tax-advantaged accounts as long as possible. As long as you can keep money in your IRA or 401k, it will grow tax-deferred until withdrawal. Any money you keep in your Roth IRA can be passed to your heirs without estate taxes or income taxes.

When Should You Start Collecting Social Security?

This is a question I get all the time and one that can add hundreds of dollars a month to your retirement income.

You can start collecting social security benefits at age 62 though for anyone born after 1960, you’ll only get 70% of your benefits. That means an average of $950 a month for the rest of your life.

You’ve worked hard and don’t want to wait to retire. While many people say they’ll wait to retire, the fact is that 40% of workers decide to start collecting SSI at 62 years of age.

And why not? You don’t know how long you’ll live. My step dad died at 42 and my mother only lived to 65 so neither benefited from paying into social security. Why should I wait to collect benefits?

The government does give you an incentive to delay collecting SSI benefits. Anyone born after 1960 will receive full benefits, about $1,360 a month, if they wait to 67 to start collecting. You also get an 8% increase for each year you delay until 70 for a potential $1,686 per month.

Many Americans will have no choice. You might have to wait to collect benefits in order to afford healthcare or other expenses. Working until 70-years of age and collecting that extra money may be the only way you make ends meet.

For others, the decision comes down to either taking social security now or using investment income for a few more years to cover expenses while you let your SSI benefit grow.

In this case, whether it pays to wait to collect social security benefits really depends on how long you plan on living. Yeah, sorry that’s not an easy answer.

I posted a detailed article on the rate of return for waiting to collect social security in this article.

We all want to live to a ripe old age but nobody knows when the time will come. The best we can do is look at the average life expectancy for people our age and make an assumption based on our health and family medical history.

The average male at 62 years old can expect to live another 20 years according life expectancy tables. Women do slightly better, expecting to live to 85 once they’ve reached their 62nd birthday.

Assuming this, I calculated the rate of return you get from waiting to collect social security. For males expecting to live until around 82 years old, the rate of return for waiting until 65 to collect benefits is 3.6% while the annual return for waiting to 70-years old compared to 65 is just 1.3% annually.

Even a super-conservative investment portfolio of 25% stocks, 60% bonds and 15% in real estate investment trusts (REITs) should be able to produce a 4.5% annual return. That means, if you are planning on delaying collecting social security and withdrawing from investments instead…think again.

The rate of return on your investments is likely higher than the return you get by delaying social security benefits.

There’s a caveat here. If you think you’ll live longer than most, based on your health or family history then it may pay to withdraw investments and delay social security. According to the table in the article linked above, waiting until 65 to start collecting benefits yields a 6% annual return for the person that lives to 92-years old. That’s a solid return for waiting, especially compared to a conservative retirement investing strategy.

You might also decide to delay social security benefits just because you enjoy working and don’t particularly need the money. If this is the case, then go ahead and let your SSI benefits grow.

The bottom line is that if you want to retire, it makes more sense to start collecting social security benefits rather than to wait and make up the income gap by withdrawing more from your investments. You will likely get a better return by taking social security benefits and withdrawing less from your retirement savings.

Closing Summary and Action Steps for Retiree Investors

You’ve made it to retirement and have earned the R&R that’s coming. However you’ve saved and managed your portfolio to this point is secondary to your new focus, using your nest egg to pay for the retirement you deserve but getting it to last for at least a few decades.

That means finding a retirement investing strategy and withdrawals that fit your needs, one that produces as much cash as possible to pay for expenses but also returns to grow your money.

- The bucket approach can help earn a relatively high return by keeping as much as possible in your growth portfolio of stocks. It is the riskiest of the three though because it doesn’t explicitly match your investments with needs.

- The matching strategy covers your expenses with a bond ladder investing strategy. It also leaves some money for growth but not quite as much as the bucket approach.

- Using annuities to cover some of your expenses guarantees you an income but also costs the most and leaves the least amount for growth.

- Understand that how you withdraw your money from retirement accounts can mean a big difference in your taxes and how long your money lasts.

- Make sure you take at least the required minimum distribution from 401k and IRA accounts each year. Then withdraw money from taxable non-retirement accounts to take advantage of lower capital gains taxes.

- Understand how social security is paid out and whether it’s worth it to wait to start collecting benefits. For most individuals, it’s not worth using investments while delaying social security payments.

Finding the right retirement investing strategy can help you pay for the retirement you’ve worked hard to earn while protecting your portfolio from collapse. You’ve worked for decades, saving for retirement and planning your dreams. Understand how to get the most out of your retirement savings and enjoy these years.