Investing before retirement is about revisiting your retirement goals and making sure your money is there when you need it.

Those last few years before retirement should be some of the happiest of your working life. You’ve worked for decades on the promise of the financial freedom to spend more time doing what you enjoy in retirement.

The light at the end of that tunnel isn’t just shining through but glaring out as a reminder the reward for your sacrifice is close at hand.

For many Americans that haven’t saved enough for retirement, that glaring light of retirement can be a little blinding and more than a little scary. The prospect of working until 70 years old doesn’t sound very appealing but neither does living on the scraps of social security for the rest of their life.

Fortunately, there are things you can do to get your investments ready for retirement whether you’ve saved enough or not.

This is the sixth in our seven-part series on life-long investing. We started with how to create your own personal investment goals and understand your investor type. Throughout the series, I’ve shown you exactly how your investments change as you age, how you can keep your portfolio matched to your needs and how to keep your retirement on track.

Check out the other three articles in the series:

- Use this introduction to create your investment goals and understand your investor type

- Find the perfect portfolio for investors in their 20s

- See how you can invest in your 30s for the right amount of risk and return

- Learn how your investment needs start changing in your 40s

- Find out how to invest in your 50s to balance both safety and growth

- Protect your investments with these pre-retirement tips

- 3 retirement investing strategies to make your money last

In this article, we’ll look at revisiting your retirement goals to get a crystal-clear picture of where you are at and how to match your investing style with your needs. We’ll talk about how your expenses will change in retirement and what to do even if you haven’t saved enough.

Finally, we’ll put together two example portfolios for pre-retirement investing that will help squeeze out additional return to meet your goals but with the protection you need to make sure your money is there when you need it!

The Pre-Retirement Investor’s Needs

We’ve followed three investor characteristics through the series that help to understand your own specific needs.

- Time horizon is how long you’ve got left to invest. This is important because it could take years for the stock market to recover from a crash. Investors with less time until they need their money should invest more in bonds.

It took six years for the S&P 500 to recover its previous high after the 2008 financial crisis. That means anyone with money in stocks before October 2007 were looking at losses on that money for a very long time.

As a pre-retirement investor, you should already have a large portion of your portfolio in bonds and real estate. We’ll be moving even more into bonds in the example portfolio below. You’ll still hold money in stocks to fight against inflation through your retirement years but the investment in bonds will provide a steady cash flow and protection.

- Liquidity needs is how much money you need from your investments within the next year or two. Any money you need in this time frame should be in extremely safe money market investments or in cash savings. Even relatively safe bond investments can lose value so you need to protect this near-term cash need.

Balancing your needs for living expenses and need for further investment growth will be a constant task in retirement. We’ll talk about a bucket system of investing in the next article on retirement investing strategies that will help ensure cash flow that pays the bills but still leaves room for growth.

With three to five years to planned retirement, you expected liquidity needs are low but that doesn’t mean you won’t need money. Unexpected medical expenses are the most common liquidity need, making it absolutely essential that you have health insurance.

A recent survey by Voya Financial found that 60% of retirees reported having to retire earlier than expected, either for medical conditions or forced retirement at work. That means having some money set aside that’s safe and ready to use even if you don’t expect to need it for a few years.

- Taxes are relatively high for pre-retirement investors, from both retirement income and interest on investments. This makes tax-deferred savings accounts and tax-free investments a smart option for investors heading into retirement.

You’ll still benefit from investing money in your 401k and IRA in pre-retirement, especially the instant deduction on any contributions you put into the accounts.

You may also benefit from investing in tax-free municipal bonds if your income is high enough. Unlike regular bonds issued by the federal government or corporations, which tax the interest you receive as income, municipal bonds are issued by local and state government. As an incentive for investors to help fund this local debt, the interest received is tax-free on the federal level and usually at the local level.

This tax break on municipal bonds may mean higher returns compared to other bonds on an after-tax basis if you are in a higher tax bracket. Anyone in the 25% tax bracket or higher should look into municipal bonds as a way to cut your tax bill but still earn a return on your money.

How to Get Your Investments Ready for Retirement

Fidelity reports that the median investor has $172,000 saved in the years before they retire. That means half the people in the survey said they had more than $172,000 and half said they had less.

Even the half that had more than that amount saved may not looking at a financially-safe retirement. That amount would only provide about $7,000 a year of income without worrying too much about running out of money if you follow the 4% rule of retirement withdrawals.

Worrying about how much you’ve saved so far is less important than figuring out how far you can stretch it and rechecking your retirement goals.

On the upside, your retirement goals and living expenses will never be clearer than they are right now. You know exactly how much you spend and can revisit your retirement goals to get a clear picture of how much money you’ll need.

Don’t forget to reduce your estimated living expenses for items you won’t need to pay anymore:

- Transportation expenses, especially gas and maintenance, usually drop since you’re not driving to work every day.

- Your budget on clothes may come down since you won’t need work clothes.

- You won’t need to save for retirement

Data from the consumer expenditures survey shows average annual expenses by age group and changes in spending for households 65 and older. It’s important to note that these don’t necessarily show retiree spending since some of the 65-74 age group might still be working.

Keep in mind that these are averages for all Americans. Your own expenses are going to vary depending on lifestyle and where you live but the table gives you a good idea of the change in spending from working to retirement.

Spending on average goes down 24% from the 55-64 age group compared to households 65 years and older. Just about every expense other than healthcare sees retirees spending less money.

Another warning though as you’re comparing your own expenses to these averages to plan your pre-retirement finances, the fact that living expenses fall so much for the average household in retirement might be just as much about necessity as it is about preference.

If the average investor has less than a couple hundred thousand saved for retirement, they’re going to be forced to cut living expenses. Many retirees are being forced to make painful cuts to their standard of living because they haven’t saved enough. That’s probably coming through in the numbers reported in the consumer spending survey.

So it may not be that households 65 and older WANT to cut their spending on entertainment by 26% compared to the 55-64 age group but they have no choice.

To be safe, I would estimate your retirement spending within 15% of your current expenses plus any planned travel or special expenses. That means multiply your current monthly or annual living expenses by 0.85 to get an idea for retirement expenses.

The average social security benefit is $1,360 a month ($16,320 a year) before taxes. You can get a better idea of how much you will be receiving when you start claiming benefits by using the retirement benefits calculator at the SSA.gov website.

The difference between your social security benefits and your estimated living expenses in retirement will need to be met by investments. For the average household 65 years or older, that means about $15,000 to $20,000 a year needed beyond social security.

There are two very important steps you need to take to get ready for retirement:

- Make sure your money is safe and waiting for you by the time you retire. We’ll cover this in our pre-retirement example portfolio in the next section.

- Address any shortfalls in the amount you have saved and the amount you expect to need in retirement.

Making up for a retirement investment shortfall comes down to making more money or putting off retirement…or both.

- Waiting to claim social security benefits, even if you are withdrawing from investments to pay for living expenses, can mean a huge increase in benefits. Americans born after 1943 get an 8% increase in SSI benefits for every year they wait to start collecting after their full retirement age. That could mean up to 24% more each month, about $4,000 a year.

- You’re going to need to do something in retirement. Might as well make money while you do it. Consider freelancing or turning your hobby into a part-time job to make extra money each month. Part-time doesn’t have to mean 20 hours a week. Spending just 10 hours a week on your hobby job can mean an extra grand in income each month.

Investor Types for Investing Before Retirement

We’ll break from the rest of the series here in the investor types we’ve covered previously. In the previous articles, we’ve talked about three investor types and how they might invest their money for retirement.

- Conservative Cody is a cautious investor and gets stressed out by swings in his portfolio. He is fine with slightly lower returns if it means a more stress-free investment approach.

- Average Amanda is our base-case investor, neither overly cautious or risk-seeking. She budgets her money and invests regularly. She doesn’t want to have to worry about her retirement savings but is willing to let the market work its magic and grow her nest egg over the long-term.

- Risky Rebecca isn’t worried about stock market crashes. She’s got a stable job, has adequate insurance coverage and doesn’t mind a little extra risk in her investments if it means a little higher return.

These three investor types in the previous articles helped to relate your own needs with a specific investing style.

In this article and the next on retirement investing, we’ll only need two investor types to build a suitable investing strategy to meet your needs. Whereas the investor types differed by characteristics like risk and return needs, the two investor types we’ll use here differ by how close they are to their retirement goal.

Investors with far less saved than they’ll need in retirement will need to be extremely cautious to protect their money and at least provide for the basic necessities. Investor that have saved close to their retirement goal might be able to take a little more risk and enjoy a higher return.

How do you know if you’ve saved enough for retirement that you can take a little more investing risk?

- Reduce your estimated living expenses by how much you expect from social security, around $16,000 for individuals or $32,000 for married couples.

- Multiply the amount you need covered by investments by 20-times.

- If you have less than 65% of that amount saved before retirement then you are probably in the low-risk group and need to protect what you have saved rather than reach for extra return. If you have between 65% and 125% of the amount, it’s up to you which investor type you choose. If you have more than 125% of the amount needed then you can definitely invest for a little extra return.

For example, say your estimated living expenses will be $42,000 a year before taxes. Accounting for social security means you’ll need to cover $10,000 a year from investments ($42,000 minus $32,000 in SSI).

Multiplying $10,000 by 20-times means you should have saved $200,000 for retirement. If you have less than $130,000 (that’s 0.65 times your $200,000 goal) then you will probably want to protect your money as much as possible to make sure you aren’t forced to cut expenses too much.

That $130,000 can still provide nearly $8,000 a year in retirement without too much risk of running out of money but you’ll need to protect it from stock market risk.

On the other end of this, if you’ve saved more than $250,000 (that’s 1.25 times your $200,000 goal) then you can afford to take a little more risk in your investments. That’s because, even if the stock market tumbles, you have enough saved that you can withdraw money from bonds or safety stocks while you wait for stocks to bounce back.

An example pre-retirement investment portfolio for the investor that needs maximum protection might look like this:

Notice that the portfolio still holds almost a third in stocks and 15% in real estate investments. You could be depending on money from your retirements for 30 years or more so you still need to earn a return and you definitely need protection against inflation. Bonds aren’t a great investment for return and do nothing to protect you from inflation.

Some might argue that you need even more in stocks. The problem with this is that if you’ve saved well under your retirement target amount, you’ll probably be spending through your investments fairly quickly. You’ll need to protect as much as possible with a higher percentage in bonds.

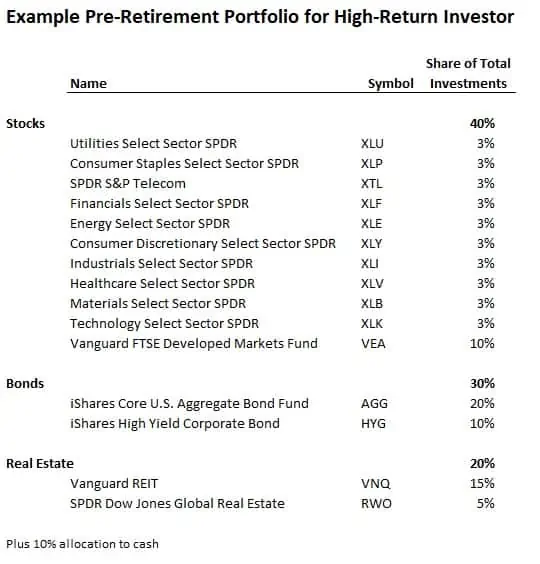

An example pre-retirement investment portfolio for the investor that can take a little more risk might look like this:

Notice here also that there is still only 40% in stocks and 20% in real estate. Even an investor with a lot saved away for retirement should hold at least a third of their investment in bonds for protection and cash flow.

This example portfolio provides for a stronger upside potential with the extra investment in stocks along with inflation protection and cash flow in real estate.

Remember, these are only example portfolios with broad-based exchange traded funds (ETFs). Investing broadly in ETFs gives you immediate diversification across hundreds and even thousands of individual stocks so you don’t have to worry about one specific stock taking a nose-dive.

You can still invest in individual stocks but I would recommend holding the majority of your stock portfolio in ETFs to balance out the risk in one particular company.

There are also alternative ETFs you can choose that will give you broad exposure to the investments above. The ETFs above are relatively low-cost and popular so the cost difference between buying and selling is negligible.

What Kind of Returns Should You Expect Investing Before Retirement?

As with the previous articles in the series on life-long investing, there isn’t a huge difference in returns you might expect from the two sample portfolios. I used ten-year returns on each ETF to estimate a return from the two portfolios.

The lower risk portfolio provides for an estimated return of 5.8% annually with about 3% of that in interest and dividends. That means you might still need to sell some of your bond investments each year in retirement to fund all your living expenses but earnings from stocks and real estate can be used to refill your bond investment.

The higher-risk and return portfolio provides for an estimated 6.3% annual return but still offers the protection your need pre-retirement. This expected return is just below the 6.4% estimate we got from the conservative portfolio for the investor in their 50s in the previous article.

With this higher-risk portfolio, you may still want to readjust it when you retire and through retirement to bring investment risk down every few years.

There is one problem with estimating returns on pre-retirement portfolios. Expected returns are based on historical averages over ten years or more. While the estimates for the two portfolios above are likely to be close to the actual returns you’ll get over ten years or more…that doesn’t mean returns in any given year or even over a few years will work out that way.

Returns on bonds are relatively smooth but your year-to-year returns on stocks and real estate will fluctuate more. That’s why we have 30% in bonds even in the higher-risk portfolio, to help cover living expenses even when stocks and real estate stumble. Holding this amount in bonds gives your other investments a few years to recover after a panic.

Closing Summary and Action Steps for Pre-Retirement Investors

Pre-retirement investing is all about revisiting your retirement needs and making sure your money is there when you need it. That means putting an exact dollar amount on your expected living expenses and the income you can expect in retirement.

It also means reducing the risk in your investments to protect the money you’ve saved. Understanding how to shuffle your investments around can give you the protection you need but still offer enough growth and return to make your money last.

- Understand how your time horizon and liquidity needs affect your investment decisions. You only have a few years before saving for retirement becomes spending in retirement so you need to balance maximum protection with the need to make your money last for decades.

- Revisit your estimated living expenses with a to-the-dollar calculation of how much you’ll need each year. Remember that some expenses will be lower while others might increase.

- Figure out how much you’ll need to spend from your investments each year to cover expenses after social security.

- If you’ve saved close to or over the amount you need, you might be able to continue taking a little more risk for higher returns. If you haven’t saved enough for retirement, don’t try to catch-up now by putting everything in stocks. Your goal should be protecting what you have and making it work.

- Understand that you’ll still need to adjust your investments through retirement, gradually reducing risk in stocks for more protection in bonds.

Pre-retirement investment planning can be a really fun task. You are within sight of your investment goals and everything for which you’ve saved and sacrificed is close-at-hand. Even if you haven’t saved enough for retirement, try to enjoy the process by tying it to your goals and how you’ll enjoy spending the money.